eToro Review 2023: Trading Platforms, Instrument Variety Pros and Cons

eToro stands tall among the global investment networks, pioneering a paradigm shift in trading approaches. This comprehensive 2023 review of eToro delves into every aspect a trader must grasp about this avant-garde online trading platform. From exploring withdrawal fees and navigating the demo account to mastering the art of copy trading, this review elucidates the mechanics of social trading and identifies the standout traders achieving financial success. Whether your interest lies in stocks, forex, or the burgeoning realm of Bitcoin, eToro is a gateway that democratizes trading for all. Discover the nuances that might influence your decision to launch a live account with eToro.

A Glimpse into eToro

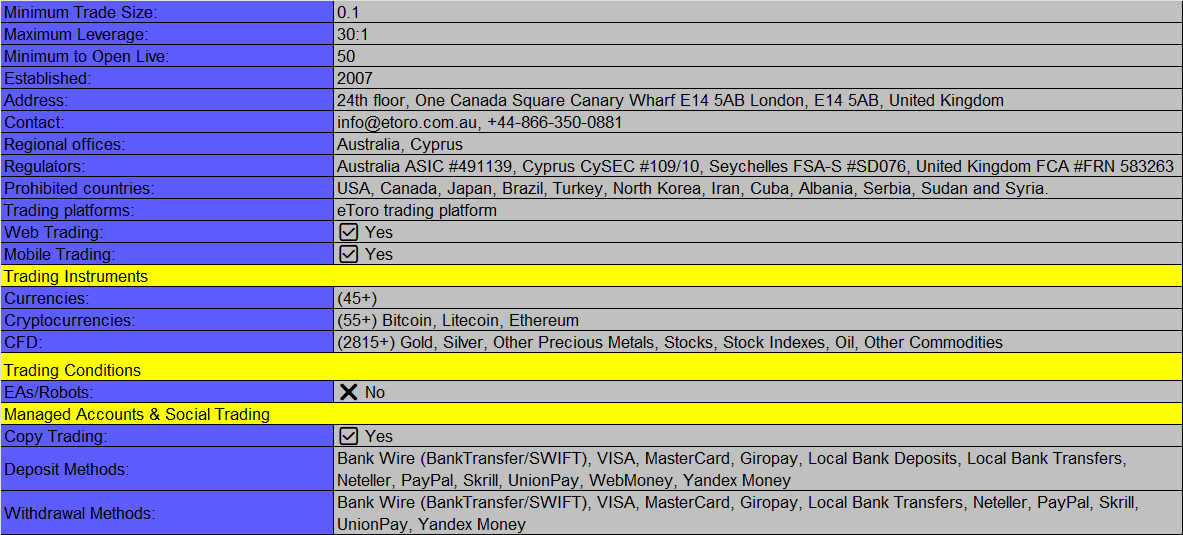

The eToro consortium stands as a globally renowned Israeli fintech brokerage, establishing its roots in 2007. Offering a staggering array of 5000 trading instruments encompassing CFDs, forex, and exchange-traded securities, eToro propels investors into a domain teeming with possibilities.

Empowering Through Innovation

The bedrock of eToro's ethos lies in empowering individuals, nurturing both their acumen and wealth within a cohesive community of like-minded investors. In 2010, eToro unfurled the world's inaugural social trading platform, the trailblazing CopyTrader™. This groundbreaking innovation beckoned investors worldwide, sparking a fintech revolution and securing global acclaim, notably winning the esteemed Finovate Europe Best of Show in 2011.

A Global Footprint

Today, eToro's reach spans the globe, boasting a staggering 27 million registered users hailing from over 140 countries. Notably, 2022 marked eToro's foray into serving US investors, signifying its unwavering commitment to global expansion.

Navigating the Ecosystem

eToro currently operates through four global entities: eToro (Europe) Ltd, eToro UK Ltd, eToro AUS Capital Limited, and eToro Seychelles Ltd. The specific trading entity pertinent to you is contingent upon your country of residence. This review shall delve into regulatory intricacies further.

Evolution of the Trading Platform

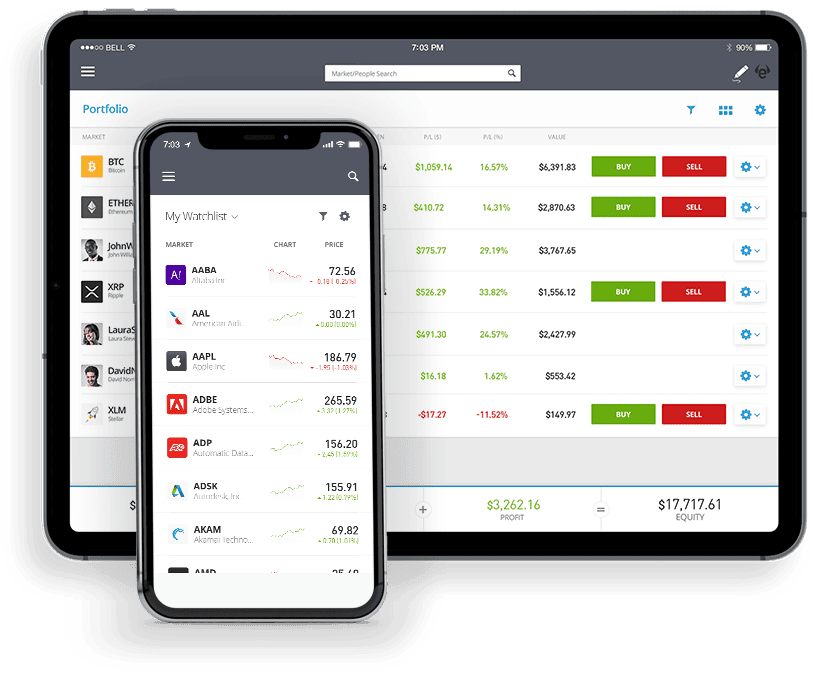

Since its momentous debut in 2010, eToro's trading platform has undergone substantial enhancements, amplifying its functionality manifold.

Seamless Accessibility

Accessible through major web browsers or as a downloadable mobile app for both iOS and Android devices, the platform ensures compatibility across all desktop and Mac devices. Its user-friendly interface and intuitive features cater to beginners, fostering an environment conducive to learning and seamless navigation.

Empowering Trading Capabilities

The multi-asset platform integrates a myriad of indispensable functions, from one-click trading to TipRanks research and a sophisticated technical analysis tool. A hallmark offering from eToro, the 'Smart Portfolio,' curates pre-designed investment strategies, empowering day traders with actionable insights.

This rewrite aims to capture the essence of eToro's prowess in reshaping the trading landscape, emphasizing its innovations and user-centric approach while steering clear of duplicated content.

Exploring eToro CopyTrader

The eToro CopyTrader platform amalgamates the fundamental aspects and legacy products of traditional trading terminals, seamlessly integrating them with novel advancements. This convergence provides clients with unparalleled access to a comprehensive interface that embodies the best of both worlds.

Unlocking Opportunities

Beyond its core function of facilitating trade replication and independent trading, eToro extends an exceptional opportunity to clients: the prospect of becoming a "Popular Investor." This distinctive feature sets eToro apart from many other brokerage platforms.

The Popular Investor Experience

As a Popular Investor, users have the privilege of sharing their trading activities with others. Upon reaching a minimum number of copiers, the trader receives rewards in the form of cash incentives and rebates on spreads.

Qualifying Criteria

To attain the coveted status of a Popular Investor, a minimum deposit of $1000 is required. Additionally, recruiting a copier with at least $500 equity or finance for a minimum period of two months is mandatory.

Innovative Offerings

In pursuit of maintaining their trailblazing status in the industry, eToro introduced the concept of "CopyPortfolios." This innovative service empowers traders to replicate a diversified selection of assets curated by eToro.

Charting and Analysis

eToro doesn't fall short when it comes to technical analysis and research tools available on its platform. Catering to both seasoned professionals and novice traders, these features offer comprehensive market data and back-testing capabilities.

Empowering Traders

The suite of tools enables real-time price analysis, facilitating the identification and marking of trends. While some forex platforms might boast superior analysis tools, eToro's charts cater to the needs of the majority of traders, irrespective of their experience levels.

Diverse Asset Offerings and Market Access

eToro has significantly broadened its spectrum of tradable assets over time, offering access to an extensive array of over 5000 instruments. This encompasses 49 currency pairs, 264 ETFs, 15 global stock indices, 24 commodities, and a comprehensive selection of 3000+ global company stocks. The inclusion of fractional shares facilitates partial ownership, effectively lowering the entry barriers for novice investors.

Pioneering Cryptocurrency Trading

As pioneers in the realm of cryptocurrency trading, eToro boasts the most extensive range of crypto tokens available, currently featuring 76 digital currency coins. The platform remains committed to expanding this market as established tokens gain mainstream recognition.

Out-of-Hours Stock Trading and Opportunities

eToro's provision of out-of-hours stock trading is a significant advantage. Clients can engage in trading activities concerning 30 prominent US stocks during extended hours, presenting fresh avenues for investment. Notable names like Tesla, Amazon, and Netflix are among the offerings available during these extended trading periods.

Transparent Fee Structure

eToro maintains transparency in its fee structure, ensuring clients are well-informed. Account opening and profile maintenance, including copy trading services and Smart Portfolios, incur no charges. Deposits to a live account are free, but a $5 withdrawal fee applies (with a minimum withdrawal of $30). However, privileged members of Platinum, Platinum+, and Diamond Club tiers may benefit from discounted withdrawal fees.

Commission-Free Stock Trading and Spreads on CFD Trades

Day traders enjoy commission-free stock investments, allowing for fractional purchases starting from as low as $10. For crypto transactions, eToro imposes a single 1% fee, inclusive of the market bid/ask price.

Spread structures apply across various CFD trades:

- Commodities range from 2 pips (e.g., oil at 5 pips, gold at 45 pips, and copper at 2 pips).

- Indices start from 0.75 points (e.g., S&P500 at 0.75 points and FTSE100 at 1.5 points).

- Currencies fluctuate from 1 pip (e.g., GBP/USD at 2 pips, GBP/EUR at 1.5 pips, and USD/JPY at 1 pip).

Currency Conversion and Inactivity Fees

Trading in a currency outside of US Dollars may incur conversion fees based on live foreign exchange market rates. Moreover, a $10 monthly inactivity fee applies after 12 months of no login activity on accounts with remaining balances. No open positions will be closed to cover this fee.

Understanding Leverage

Leverage is available across all CFD traded instruments but is subject to variations in available margin and eToro trading entity. While it can be customized, leveraging is not obligatory. Here's the maximum leverage for day traders:

- Commodities – 1:10

- Cryptocurrency – 1:2

- Stocks and ETFs – 1:5

- Major currency pairs – 1:30

- Minor currency pairs, indices, and gold – 1:20

Mobile Trading Access

eToro offers a free mobile trading app compatible with iOS and Android devices, enabling seamless trading experiences on the go. The app mirrors the main web platform's functionalities, providing real-time trading, access to historical trades, news, customer service, copy trading services, and watchlists. Recent updates have optimized the app's performance, enhancing speed without compromising functionality.

Deposits and Withdrawals: A Comprehensive Overview

At eToro, funding your trading account or initiating withdrawals is a straightforward process, offering various avenues to manage your finances efficiently. The initial minimum deposit requirements vary depending on the trading entity, ranging from $10 to $10,000. For instance, when engaging with eToro's platform in the UK, a mere $50 (or the equivalent in GBP) was required to commence trading.

Accessibility and Supported Payment Methods

In line with fostering accessibility, the majority of jurisdictions align with the $50 minimum deposit requirement, ensuring accessibility for novice investors seeking entry into the investment sphere.

Below, we outline the supported payment methods, each designed to cater to specific regions and currencies:

- POLi: Offers instant processing, available to Australian traders in AUD only, with a maximum deposit limit of $10,000.

- Przelewy 24: Facilitates instant processing for traders in Poland in PLN only, featuring a maximum deposit limit of $11,500.

- iDEAL: Provides instant processing for traders in the Netherlands in EUR only, with a maximum deposit limit of $50,000.

- eToro Money: Instant processing available to UK investors in GBP only, allowing a maximum single deposit of £250,000.

- Skrill & Neteller: Instant processing available to international investors in USD, EUR, or GBP currency, with a maximum deposit limit of $10,000.

- Rapid Transfer: Facilitates instant processing for EEA investors (subject to restrictions) in USD, EUR, or GBP currency, featuring a maximum deposit limit of $5,500.

- Credit/Debit Cards: Offers instant processing to international investors in USD, AUD, EUR, or GBP currency, with a maximum deposit limit of $40,000.

- Bank Wire Transfer: Requires four to seven days for processing and is available to international investors in USD, EUR, or GBP currency, with no maximum deposit limit.

- PayPal: Provides instant processing to international investors (subject to restrictions) in USD, AUD, EUR, or GBP currency, with a maximum deposit limit of $10,000.

- Klarna/Sofort: Facilitates instant processing for traders in select European countries in EUR currency only, offering a maximum deposit limit of $30,000.

When initiating deposits into your eToro account, follow these simple steps:

- Log in to your account

- Click on ‘deposit funds’

- Enter the desired amount and chosen currency

- Select your preferred deposit method

Withdrawal requests typically undergo processing within three business days. However, ensure that the withdrawn amount meets a minimum of $50; requests below this threshold will be rejected. Please note, a withdrawal fee of $5 applies to each transaction.

eToro Money and Debit Card Access

eToro introduces a complimentary physical debit card for UK traders, accessible to holders of the broker’s investment account. This exclusive card facilitates instant and fee-free deposits without FX conversion charges, enabling users to spend their funds conveniently and globally. Additionally, the payments area enables global transactions at competitive conversion rates.

For EU clients in select countries like Cyprus, Ireland, France, Italy, and Portugal, a digital debit card is available, with plans for a global rollout in the future.

Access to Demo Accounts

eToro provides a free demo account for traders seeking to explore the platform's tools and services without risking actual funds. This simulated trading environment is credited with $100,000, allowing users to build a virtual multi-asset portfolio, trade cryptocurrencies, and access live real-time prices.

Bonuses, Regulation, and Licensing

While utilizing the eToro platform, our experience didn't entail any promotional or joining bonus incentives. Some global territories adhere to ESMA restrictions on financial incentives implemented in 2018.

eToro operates under four global entities, each regulated by the following authorities:

- eToro UK Ltd – Regulated by the Financial Conduct Authority (FCA) under license FRN 583263.

- eToro (Europe) Ltd – Regulated by the Cyprus Securities Exchange Commission (CySEC) under license #109/10.

- eToro Seychelles Ltd – Licensed by the Financial Services Authority Seychelles (FSA) under Securities Act 2007 License #SD076.

- eToro AUS Capital Limited – Registered with the Australian Securities and Investments Commission (ASIC) under Australian Financial Services License 491139.

The level of support and protection varies across these regulators, with CySEC, the FCA, and ASIC providing retail investor compensation schemes and segregated client funds. eToro ensures negative balance protection, preventing losses exceeding the invested amount.

Please note, eToro is accessible in multiple jurisdictions, including Mexico, Singapore, Malaysia, and Nigeria, yet not available in Canada and India, among others. Complying with tax obligations in your local jurisdiction is your responsibility.

Additional Offerings

Education

eToro boasts an extensive range of educational resources, catering to day trading clients. The online training academy is a treasure trove for aspiring investors, featuring integrated video content, live webinars, podcasts, online tutorials, and comprehensive step-by-step guides.

Topics are structured based on experience levels, offering valuable insights regardless of your trading background. Dive into long-term investment strategies, risk management tools like stop loss features, and mastering trade leveraging techniques.

Crypto Wallet

With eToro's multi-crypto on-chain wallet, users can securely manage cryptocurrencies. The phased rollout of this feature will expand country by country, offering an ever-growing list of cryptocurrencies. The wallet ensures high-level security, supporting multi-signature sign-in to allow blockchain transaction viewing without exposing private keys.

The mobile app, available on Google Play and the Apple App Store, facilitates cryptocurrency trading using fiat currency. Users can also convert between various cryptocurrencies. Although initially limited to Platinum Account holders, this feature will eventually be accessible to all traders.

NFT Trading

In response to the surging demand for non-fungible tokens (NFTs), eToro introduced a $20 million NFT fund in 2022—eToro.art. This initiative aims to support NFT creators and brands, reducing barriers for potential investors. An additional $10 million investment in 2022 will further enhance NFT projects, aiming to lower entry thresholds for everyday investors interested in NFT drops and collections.

Account Types and Features

eToro simplifies the trading experience by providing a standard trading profile. Opening an account is a straightforward process requiring completion of an online registration form. New profiles can be approved within one working day. A professional account option is available in specific jurisdictions.

One notable feature is the opportunity to earn annual interest of up to 5.3% on unused funds, a unique perk not commonly found elsewhere, allowing users to capitalize on their funds while identifying market opportunities.

Operating Hours and Customer Support

The platform operates 24/7, aligning with market hours. Trading is available when markets are open, including weekend trading during active market hours.

While customer support is available 24/7 from Monday to Friday, the available contact methods are limited. Clients may use the online contact form or access live chat services within the platform interface. Unfortunately, direct email or helpline phone number options are not available.

Safety and Security

eToro ensures a secure trading environment, utilizing Secure Socket Layer (SSL) technology for all transactions, safeguarding personal information. Client funds are held in secure tier-one banks, and users can enhance security with 2-factor authentication (2FA). Additionally, eToro maintains a Vulnerability Disclosure Program on HackerOne to address submitted security issues.

Is eToro Suitable for Day Trading?

For beginners, eToro's social trading feature can enhance profitability. However, it's essential to note that eToro's spreads are higher compared to other providers. As a day trader relying on small margins, these additional costs may impact overall daily profits.

eToro Verdict

eToro stands as a prominent global brokerage, offering an innovative social trading platform and access to numerous assets within a single profile. Day traders can leverage the extensive learning academy, copy trading, and crypto-based features, all within regulatory-approved entities. With something for everyone, eToro warrants exploration as an investment platform.

Pros and Cons

Pros

- Large User Community: Over 25 million users.

- Interest Earnings: Up to 5.35% on unused funds.

- Top-Notch Copy Trading App: Leading the industry.

- Commission-Free Stock Trading: No fees.

- Islamic/Halal-Friendly Account: Catering to specific needs.

- Positive User Reviews: Good app rankings and feedback.

- Low Minimum Deposit: Accessible for all.

- Various Order Options: Including take profits.

- Digital Wallet Diversity: Supporting multiple currencies.

- Reliable and Award-Winning Company: Trusted reputation.

- Extensive Training Academy: Comprehensive educational resources.

- Demo Account Access: Practice with virtual funds.

Cons

- Withdrawal Fee: Charged for revenue withdrawals.

- Limited Contact Methods: Few ways to reach support.

- Absence of Guaranteed Stop Loss: Feature not available.

- No MetaTrader 4 (MT4) or MetaTrader 5 (MT5): Not supported.

- Currency Conversion Fees: Applicable for non-USD account denominations.

Etoro Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion