Doo Prime Review 2023: Pros, Cons, and In-Depth Analysis

Hey there, folks! In this Doo Prime review, we're diving deep into the world of online trading to help you make informed decisions. We'll break down the ins and outs, the good and the not-so-good of this multi-regulated broker, so you can decide if it's the right fit for your trading journey.

Assets & Markets:

Doo Prime isn't messing around when it comes to assets and markets. They offer a staggering 10,000+ assets spread across six different classes. If you're the kind of trader who loves diversity in your portfolio, you're in for a treat.

- Metals: They've got everything from gold and silver ETFs to CFDs and futures.

- Energies: While it's not the widest selection, you can find a few crude oil and gas instruments here.

- Stocks: US and Hong Kong stocks are on the menu, including big names like Apple and Tesla.

- Forex: With over 60 currency pairs, including the likes of USD/JPY, EUR/CAD, and GBP/USD, forex enthusiasts will feel right at home.

- Indices: Choose from over 10 stock indices, featuring big players like DAX 30, US SPX 500, and Russell 3000.

- Futures: If futures are your game, they've got you covered with options like NASDAQ100 and soybean futures, along with gold CFD futures.

Account Types:

Doo Prime has three different account types: Cent, STP, and ECN. Let's break it down:

Cent

- Best for beginners: A perfect starting point.

- Account Currency: USC

- Minimum Lot Size: 0.01

- Maximum Lot Size: 1000

- Minimum Deposit: 100 USC

- Limit And Stop Limit Orders: 50 points

- Trading Products: Forex, Metals, Commodities

STP

- Best for beginners, stocks, and futures traders: A versatile choice.

- Account Currency: USD

- Minimum Lot Size: 0.01

- Maximum Lot Size: 100

- Minimum Deposit: 100 USD

- Limit And Stop Limit Orders: 50 Points

- Trading Products: Metals, Commodities, Indices, Stocks, Forex, Futures

ECN

- Best for experienced day traders: The pros' choice.

- Account Currency: USD

- Minimum Lot Size: 0.01

- Maximum Lot Size: 100

- Minimum Deposit: 5000 USD

- Limit And Stop Limit Orders: Unlimited

- Trading Products: Metals, Commodities, Indices, Stocks, Forex, Futures

The Cent and STP accounts are perfect for beginners who want lower deposit requirements and reasonable fees. If you're an active and experienced day trader looking for the tightest spreads, the ECN account is your go-to.

But, here's a little hiccup - there's no Islamic swap-free account available for Muslim traders.

How to Open an Account:

Setting up an account with Doo Prime is a walk in the park. Here's how you do it:

- Register: Get started by entering your email or phone number and choose a password.

- Verify: Confirm your account through the verification email or text message.

- Provide Details: Share your nationality, name, and submit identity documents for verification.

- Contact Info: Fill in your contact information.

- Compliance Document: Sign the compliance document.

Payment Methods:

When it comes to payment methods, Doo Prime spoils you with choices. They offer 20 funding methods in 22 different currencies, so you can avoid those pesky currency conversion fees. You can deposit through local and international bank transfers, credit cards, Apple Pay, Google Pay, Epay, Skrill, Fasapay, and HWGC. While it's a bit of a downer that global e-wallets like PayPal aren't supported, it's a minor complaint.

For withdrawals, bank transfers and e-wallets are available, but credit cards are not, and there are fewer currency options when taking out your funds.

But the good news is there are no deposit or withdrawal fees (except for third-party fees), which is a step up from some other brokers that might hit you with a $5 withdrawal fee.

Overall, Doo Prime's payment methods are right up there with the best in the business.

How to Deposit Funds:

Depositing funds with Doo Prime is a simple process:

- Log In: Access the client portal.

- Fund Icon: Click on the 'Fund' icon in the menu on the left.

- Deposit Icon: Click on the 'Deposit' icon in the drop-down menu.

- Choose Payment Method: Select your preferred payment method and enter the amount you want to transfer.

- Confirm: Verify and confirm the deposit.

Trading Fees:

Doo Prime's trading fees fall into the "average" category. While they advertise spreads as low as 0.1 pips, we found slightly higher spreads in our testing. GBP/USD had 1.3 pips, and EUR/AUD showed 1.7 pips, which isn't the lowest in the market.

On the bright side, the CENT and STP accounts have zero transaction fees, but it's a bummer that ECN accounts have transaction fees.

One thing we didn't particularly like was the lack of transparency around real-time spreads and commissions. The pricing information could be clearer.

Non-Trading Fees:

Doo Prime doesn't hit you with inactivity fees, which is fantastic compared to some brokers like XTB, who charge $10 per month after 12 months of inactivity. The copy trading tools are also free for account holders, making it a great option for beginners.

Trading Platforms:

Doo Prime offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two well-known and reliable trading platforms. Whether you're a newbie or a seasoned trader, both platforms are user-friendly and packed with advanced tools.

- MetaTrader 4 (MT4): With 9 timeframes, 31 graphical objects, and 30 technical indicators, MT4 is a great choice for beginners. It's also got Expert Advisors (EAs) and in-depth pricing history.

- MetaTrader 5 (MT5): If you're an experienced trader looking for more analysis tools and order types, MT5 is your match. It offers 21 timeframes, 38 technical indicators, and a built-in economic calendar.

- TradingView: Doo Prime also supports TradingView, offering upper-end Pine Scripts, 50 smart drawing tools, and customizable chart types. It's a haven for technical traders.

- FIX API 4.4 Pros: This platform provides direct market access, automatic exchange and hedging of currency pairs, and stable, high-frequency information transmission speed. It's tailored for technical traders who need low-latency trading.

How to Place a Trade:

Placing a trade on either of the MetaTrader platforms is as easy as pie:

- Select Your Asset: Click on the asset you want to trade.

- New Order: In the 'New Order' pop-up, enter the lot volume.

- Stop Loss and Take Profit: Adjust them if needed.

- Order Type: Choose between instant or pending.

- Execute: Click 'Buy' or 'Sell' to make the trade.

Mobile App:

Doo Prime's proprietary mobile app, Doo Prime InTrade, is available for both iOS and Android. It seamlessly integrates with your MetaTrader terminals, allowing you to keep an eye on your accounts and investments while you're on the move.

The app is user-friendly and provides real-time price data, trading history, market news, and more. It's a handy companion for traders on the go.

Regulation & License:

When it comes to regulation, Doo Prime gets a thumbs up from our experts. The Doo Group is regulated by top-tier institutions, including the SEC and FINRA in the US, the UK's FCA, and Australia's ASIC. They also hold offshore licenses with the Seychelles FSA, Mauritius FSC, and Vanuatu FSC.

While we trust Doo Prime, it's essential to note that the level of client protection can vary depending on your jurisdiction. The offshore entities are offered to traders in regulated areas like the UK, which may impact account and fund safety.

Security:

Doo Prime takes security seriously. They use multi-encryption, including 256-bit SSL asymmetric transmission, to protect clients and traders against DDoS/CC cyber-attacks.

Leverage:

Leverage at Doo Prime depends on the asset and your location. The broker offers high leverage, up to 1:1000 through some entities, which is well above the UK/AU/EU cap of 1:30. High leverage can provide more purchasing power, but it also comes with higher risk. So, be sure to practice solid risk management.

Demo Account:

Doo Prime offers a free demo mode to simulate STP and ECN accounts, making it a great option for beginners and experienced traders looking to test their strategies risk-free. Unfortunately, there's no demo available for the Cent account, which is primarily aimed at beginners.

Bonuses & Promotions:

At the time of writing, Doo Prime offers a lucky draw event where you can win luxury prizes, including cars, iPhones, and up to $888. While bonuses are nice, remember that your choice of broker should be based on more than just bonuses. Consider other factors like accounts, fees, and trading tools.

Additional Tools:

Doo Prime impresses with a variety of additional trading tools, including two copy-trading platforms and top-notch market analysis from Trading Central.

Social & Copy Trading: Doo Prime's social trading platforms, Outrade and FOLLOWME,

allow traders to communicate and share information with experienced traders globally. You can follow and copy other strategies to match your goals. These tools are especially useful for beginners looking to learn from others.

Trading Central: Doo Prime also offers Trading Central, a popular analytics software with over 8000 trading tools and real-time analysis. It's user-friendly and provides in-depth daily insights on key markets.

VPS: Doo Prime offers a virtual private server (VPS) for high-volume traders who need uninterrupted trades at fast speeds. Keep in mind that you'll need to deposit $5000 to use the VPS.

Education & Research:

Doo Prime's news page is a treasure trove of company news, market updates, product notifications, and analysis. They offer a plethora of content that rivals top brokers like IG Index.

In addition to the news, traders gain access to MTE media, an educational tool offering trading courses, e-books, investment tips, and a trading glossary. While it's beneficial for beginners, it might not compete with the likes of eToro.

Customer Support:

Doo Prime provides 24/7 customer support through email, live chat, phone numbers, and social media channels. They also have a FAQ section, although it's not as extensive as some competitors.

Our experience with email and live chat support was positive, with prompt and helpful responses. However, more specific questions required passing onto the Account Manager, and those responses were a bit slower. There's room for improvement, especially when compared to competitors like CMC Markets.

Phone number: +85237044241

Contact form: In the broker's help center

Live chat: Found at the bottom right-hand side of the brokerage's website

Email: en.support@dooprime.com

Company Background:

Doo Prime is an online stock and forex broker established in 2014. They have over 90,000 users in 40 countries and offices in Dallas, Sydney, Singapore, Hong Kong, Dubai, and Kuala Lumpur. The broker employs over 750 people and has 250+ institutional partners. They've earned multiple awards, including the Excellent Customer Service Award in the Global Derivatives Real Trading Competition and the Best Broker in the Financial Technology Honor Awards.

Trading Hours:

Trading hours at Doo Prime vary depending on the asset you want to trade. For instance, securities can be traded from 2:30 pm on Monday until 9:00 pm on Friday, while forex is available from 10:06 pm on Sunday until 9:55 pm on Friday. You can check the broker's website for a trading calendar to keep track of events affecting market opening times.

Doo Prime Verdict: A Balanced Choice

Doo Prime offers a comprehensive range of trading options with a diverse selection of assets, low minimum deposits, reliable platforms, and useful tools. The fact that they are regulated by multiple trustworthy bodies like the FCA, ASIC, and SEC adds to their credibility.

On the flip side, transparency around fees could be improved, and the educational resources don't quite match up with some of the top competitors. Customer service, while generally good, could use a bit of a boost. Also, if cryptocurrency trading is your thing, you won't find it here.

So, there you have it, the pros and cons of trading with Doo Prime. It's time for you to weigh the options and decide if this broker is the right fit for your trading journey. Happy trading!

Pros and Cons

Pros:

- Diverse Range of Trading Instruments: Doo Prime offers over 10,000 assets across 6 different asset classes, providing traders with a wide selection of investment options. This includes forex pairs, stocks, indices, commodities, and more.

- Multiple Account Types: Doo Prime offers three account types (Cent, STP, ECN), catering to both beginners and experienced traders. Each account type has its own features, making it suitable for different trading preferences.

- Competitive Minimum Deposit: The minimum deposit requirements for the Cent and STP accounts are relatively low, starting at $100, which is accessible to many traders. While not the lowest, it's competitive in the market.

- Wide Range of Payment Methods: Doo Prime supports 20 funding methods in 22 different currencies, making it convenient for traders from around the world to deposit and withdraw funds.

- No Deposit or Withdrawal Fees: The absence of deposit and withdrawal fees (except for third-party fees) is a significant advantage, as it saves traders money on transaction costs.

- Regulation: Doo Prime is regulated by reputable institutions such as the SEC, FINRA, FCA, ASIC, and several offshore entities. This multiple-regulation provides a level of trust and security for traders.

- User-Friendly Trading Platforms: The broker offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their user-friendliness and advanced trading tools. They also support TradingView and FIX API platforms for experienced traders.

- High Leverage: Doo Prime offers high leverage of up to 1:1000 on some entities, which can provide traders with more trading power. However, this comes with higher risk, so risk management is essential.

- Demo Accounts: Doo Prime offers free demo accounts for STP and ECN accounts, allowing traders to practice and test their strategies without financial risk.

- Additional Trading Tools: The broker provides social trading platforms (Outrade and FOLLOWME), Trading Central for analytics, and a virtual private server (VPS) for uninterrupted trading, catering to various trader needs.

Cons:

- Limited Educational Materials: Doo Prime's educational resources are not as extensive as some other brokers, making it less appealing for traders who rely heavily on educational content.

- Weak Regulatory Cover through Offshore Entities: While Doo Prime is regulated by reputable bodies, it also offers offshore entities to traders in regulated areas, which may reduce account and fund safety.

- Mediocre Customer Service: Some traders found the customer service to be lacking, with slow responses and difficulty in answering specific questions.

- High VPS Deposit Requirement: To use the VPS service, a relatively high deposit of $5000 is required, which may be prohibitive for some traders.

- No Swap-Free Account: Doo Prime does not offer Islamic swap-free accounts for Muslim traders, which could limit its appeal to this demographic.

- Average Spreads and Trading Fees: While Doo Prime advertises low spreads, real-time spreads and commissions are sometimes unclear, and they may not always be as competitive as other brokers.

- No Cryptocurrency Trading: Doo Prime does not offer cryptocurrency trading, which may be a drawback for traders interested in digital assets.

In summary, Doo Prime provides a diverse range of trading instruments and platforms, but it has some drawbacks, particularly in terms of educational resources and customer service. Its strength lies in its multiple regulatory bodies and a wide array of supported payment methods, making it a potentially attractive option for some traders. However, individual preferences and priorities will determine whether Doo Prime is the right choice for you.

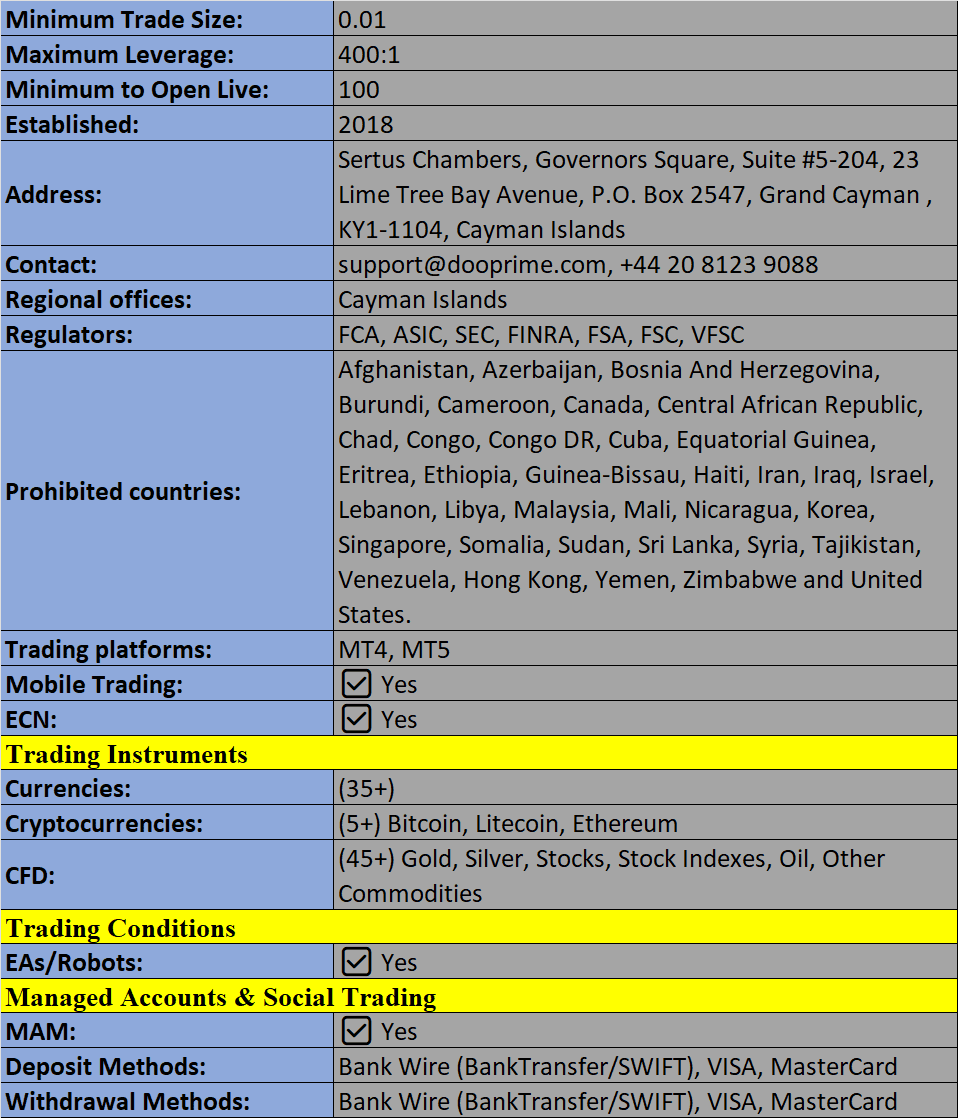

Doo Prime Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion