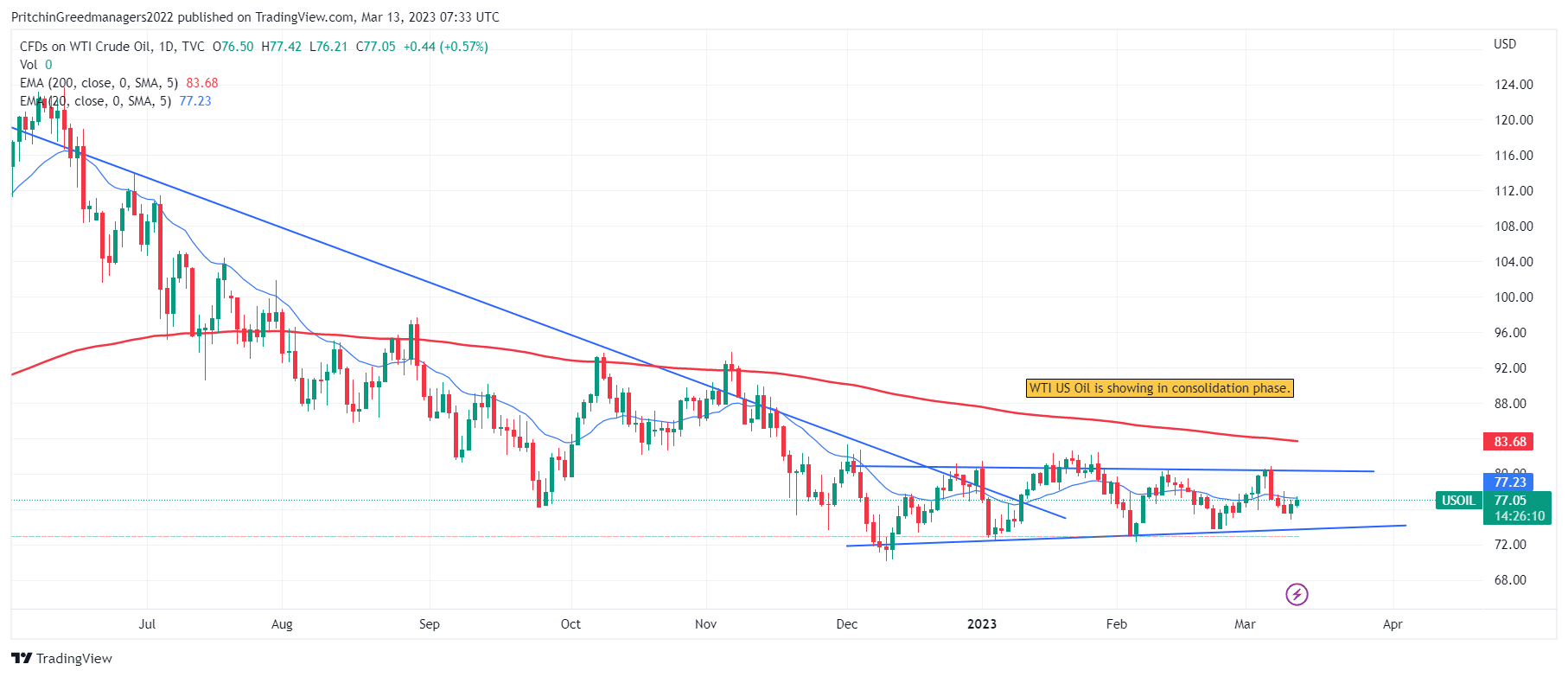

Daily Analysis For WTI Crude (US Oil) 13-03-2023

| GMT | Event | Currency | |

|---|---|---|---|

| 13:00 | - | (Ecuador) Balance of Trade | USD |

| 15:00 | - | (United States) Consumer Inflation Expectations | USD |

| 15:30 | - | (United States) 3-Month Bill Auction | USD |

| 15:30 | - | (United States) 6-Month Bill Auction | USD |

| Support | Resistance | ||

|---|---|---|---|

| S1 92.93 | - | R1 105.59 | |

| S2 90.06 | - | R2 108.75 | |

| S3 85.41 | - | R3 116.64 |

Discussion