| 00:50 | (Japan) BoJ Monetary Policy Meeting Minutes | Medium | JPY |

| 01:00 | (France) Victory in Europe Day | None | EUR |

| 01:00 | (United Kingdom) Bank Holiday for the coronation of King Charles III | None | GBP |

| 01:30 | (Japan) Jibun Bank Services PMI | Medium | JPY |

| 01:30 | (Japan) Jibun Bank Composite PMI | Low | JPY |

| 02:30 | (Australia) Building Permits MoM | Medium | AUD |

| 02:30 | (Australia) Private House Approvals MoM | Low | AUD |

| 02:30 | (Australia) Building Permits YoY | Low | AUD |

| 02:30 | (Australia) NAB Business Confidence | High | AUD |

| 06:00 | (Estonia) Inflation Rate YoY | Low | EUR |

| 06:00 | (Estonia) Inflation Rate MoM | Low | EUR |

| 06:00 | (Estonia) CPI | Low | EUR |

| 07:00 | (Finland) Balance of Trade | Low | EUR |

| 07:00 | (Germany) Industrial Production MoM | Medium | EUR |

| 09:00 | (Australia) Myfxbook AUDUSD Sentiment | Medium | AUD |

| 09:00 | (Switzerland) Myfxbook USDCHF Sentiment | Medium | CHF |

| 09:00 | (Japan) Myfxbook USDJPY Sentiment | Medium | JPY |

| 09:00 | (European Union) Myfxbook EURUSD Sentiment | Medium | EUR |

| 09:00 | (United Kingdom) Myfxbook GBPUSD Sentiment | Medium | GBP |

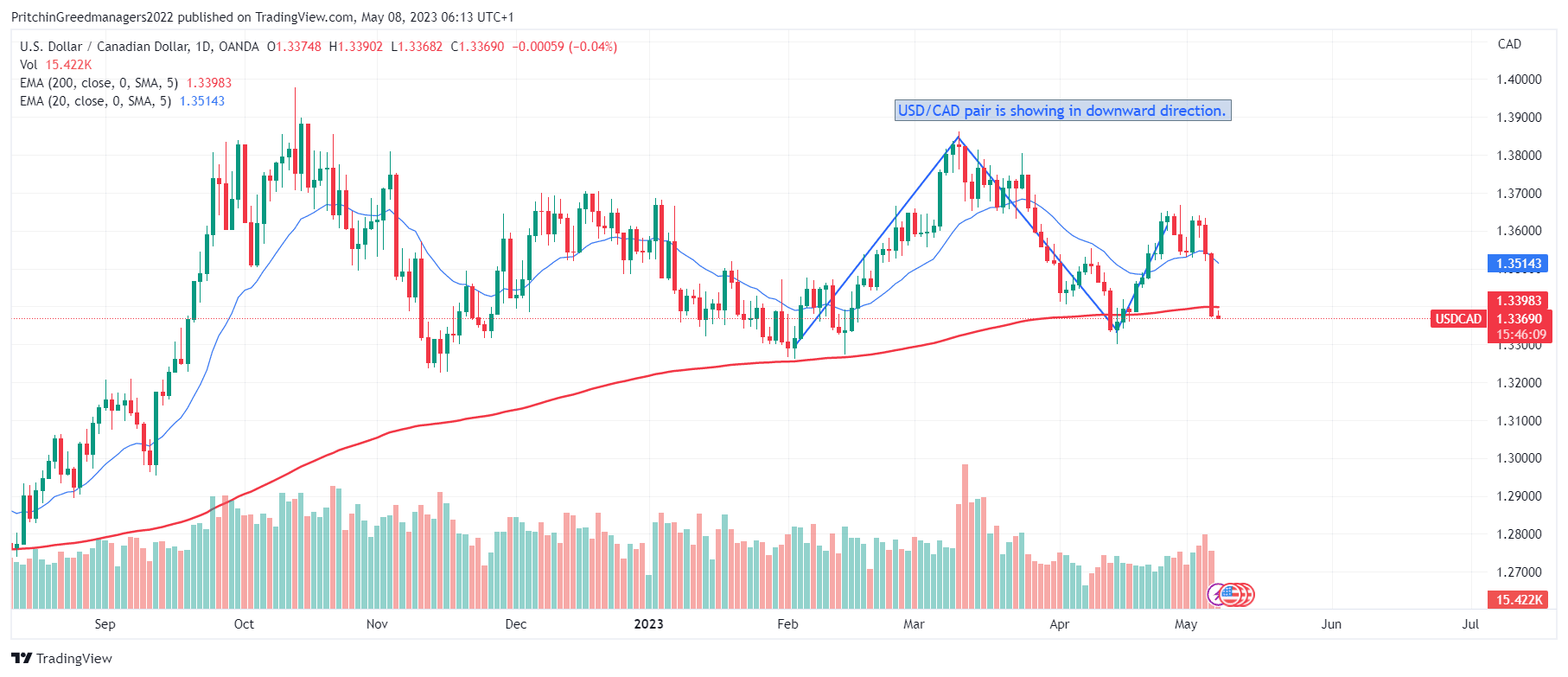

| 09:00 | (Canada) Myfxbook USDCAD Sentiment | Medium | CAD |

| 09:00 | (New Zealand) Myfxbook NZDUSD Sentiment | Medium | NZD |

| 10:00 | (Greece) Balance of Trade | Low | EUR |

| 10:30 | (Germany) 3-Month Bubill Auction | Low | EUR |

| 11:00 | (Spain) Consumer Confidence | Medium | EUR |

| 11:00 | (Latvia) Industrial Production MoM | Low | EUR |

| 11:00 | (Latvia) Industrial Production YoY | Low | EUR |

| 15:00 | (El Salvador) Inflation Rate YoY | Low | USD |

| 15:00 | (El Salvador) Inflation Rate MoM | Low | USD |

| 15:00 | (United States) Wholesale Inventories MoM | Low | USD |

| 16:00 | (United States) Consumer Inflation Expectations | Low | USD |

| 16:30 | (United States) 3-Month Bill Auction | Low | USD |

| 16:30 | (United States) 6-Month Bill Auction | Low | USD |

| 23:45 | (New Zealand) Electronic Retail Card Spending MoM | Low | NZD |

| 23:45 | (New Zealand) Electronic Retail Card Spending YoY | Low | NZD |

Discussion