Currency-Hedged ETFs: Safeguarding Your Investments from Foreign Exchange Risks

In the fast-paced world of global investing, foreign exchange (FX) risks pose a significant challenge to investors. Currency exchange rates can fluctuate rapidly, impacting the returns on international investments. However, savvy investors have found a shield against this volatility through Currency-Hedged Exchange-Traded Funds (ETFs). In this comprehensive guide, we will delve into the world of Currency-Hedged ETFs and explore how they protect investments from foreign exchange risks.

Understanding Foreign Exchange Risks

Before we dive into the benefits of Currency-Hedged ETFs, let's understand the nature of foreign exchange risks. When you invest in international markets, your returns are exposed to fluctuations in the value of foreign currencies relative to your home currency. These fluctuations can be significant and may either amplify or dampen your investment gains.

The Impact of Currency Fluctuations on Investments

Currency fluctuations can have a profound impact on investments. Let's consider an example to illustrate this point:

Suppose you are a U.S. investor who purchased shares in a European company when the exchange rate was 1 USD = 0.85 EUR. At that rate, you invested $10,000, which translated to 8,500 EUR.

Now, if the euro weakens against the U.S. dollar, let's say to 1 USD = 0.90 EUR, the value of your investment in USD terms would decrease. Your 8,500 EUR investment would now be worth $9,444, resulting in a loss of $556.

On the other hand, if the euro strengthens to 1 USD = 0.80 EUR, the value of your investment would increase, leading to a gain.

The Need for Currency-Hedged ETFs

Given the potential impact of currency fluctuations on investments, it becomes crucial for investors to find ways to hedge against these risks. Currency-Hedged ETFs offer an effective solution.

What are Currency-Hedged ETFs?

Currency-Hedged ETFs are a specialized type of exchange-traded fund designed to mitigate the impact of foreign exchange rate movements on investment returns. These ETFs

employ various strategies to shield investors from currency volatility.

How Currency-Hedged ETFs Work

Currency-Hedged ETFs typically track the performance of a specific index, such as the S&P 500 or MSCI World Index. The unique aspect of these funds lies in their use of financial instruments, such as forward contracts and currency swaps, to offset the currency risk associated with the underlying assets.

When the value of the foreign currency rises relative to the investor's home currency, the value of the currency hedge also increases. This helps neutralize the negative impact of currency appreciation on the investment returns.

Advantages of Currency-Hedged ETFs

Currency-Hedged ETFs offer several advantages that make them appealing to global investors:

- Stability in Returns: By eliminating or reducing currency risk, these ETFs provide investors with more stable and predictable returns, unaffected by exchange rate fluctuations.

- Diversification Benefits: Currency-Hedged ETFs enable investors to diversify their portfolios globally without the fear of significant currency-related losses.

- Greater Confidence: With currency risks hedged, investors can focus on the fundamental performance of the underlying assets, leading to increased confidence in their investment decisions.

- Long-Term Planning: Hedging currency risk is especially valuable for long-term investors who seek to preserve and grow their wealth over extended periods.

Types of Currency-Hedged ETFs

There are various types of Currency-Hedged ETFs, catering to different investment preferences:

1. Geographical Focus: - Currency-Hedged ETFs can be region-specific, focusing on hedging the currency risk associated with investments in specific regions like Europe, Asia, or emerging markets.

2. Asset Class: - Some Currency-Hedged ETFs target specific asset classes, such as equities, bonds, or commodities, providing investors with the flexibility to hedge their preferred asset type.

3. Inverse Currency ETFs: - Inverse Currency ETFs offer a unique approach by allowing investors to bet against a specific currency's performance. These ETFs are suitable for those who believe a particular currency will depreciate.

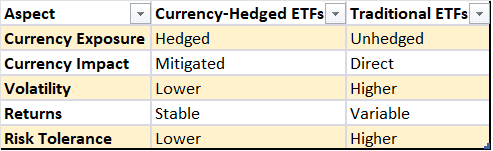

Comparing Currency-Hedged ETFs vs. Traditional ETFs

When it comes to investing in international markets, investors have a choice between Currency-Hedged ETFs and Traditional ETFs. Each option has its pros and cons, and the decision depends on individual investment objectives and risk tolerance.

Investors who prioritize stability and seek protection against currency volatility may prefer Currency-Hedged ETFs. On the other hand, those willing to embrace higher risk and potentially higher returns may opt for Traditional ETFs.

How to Choose the Right Currency-Hedged ETF

Selecting the most suitable Currency-Hedged ETF requires careful consideration of various factors:

- Investment Goals: Clearly define your investment objectives, risk tolerance, and time horizon to align with an appropriate Currency-Hedged ETF.

- Underlying Assets: Research the assets included in the ETF's portfolio to ensure they match your investment strategy and geographical preferences.

- Expense Ratio: Compare the expense ratios of different Currency-Hedged ETFs to find the most cost-effective option.

- Fund Performance: Analyze historical performance to assess how well the ETF has maintained its currency hedge and delivered returns.

Footnote

Currency-Hedged ETFs have emerged as indispensable tools for global investors seeking to safeguard their investments from foreign exchange risks. By neutralizing the impact of currency fluctuations, these ETFs provide stability and confidence to investors as they navigate the complex world of international markets.

Incorporating Currency-Hedged ETFs into your investment portfolio can help you achieve your long-term financial goals and protect your hard-earned money from the uncertainties of the foreign exchange market.

FAQs

1. What is a Currency-Hedged ETF?

A Currency-Hedged ETF is a specialized type of exchange-traded fund designed to mitigate the impact of foreign exchange rate movements on investment returns.

2. How do Currency-Hedged ETFs work?

Currency-Hedged ETFs use financial instruments like forward contracts and currency swaps to offset the currency risk associated with the underlying assets.

3. What are the advantages of Currency-Hedged ETFs?

Currency-Hedged ETFs provide stability in returns, diversification benefits, greater confidence, and are ideal for long-term planning.

4. How do Currency-Hedged ETFs differ from Traditional ETFs?

Currency-Hedged ETFs offer protection against currency volatility, while Traditional ETFs expose investors directly to currency fluctuations.

5. How can I choose the right Currency-Hedged ETF?

Consider factors such as your investment goals, underlying assets, expense ratio, and fund performance to select the most suitable Currency-Hedged ETF for your needs.

Discussion