Currency Correlations: Discuss the concept of currency correlations and how understanding these relationships can help traders manage risk

Introduction In the ever-changing world of forex trading, each move has important implications. For traders must have an understanding of the various markets that impact the movements of currencies. One of these is "currency relationships," which refers to the relation between different currencies and the way they are likely to change in relationship to one another. This article delved into the notion of correlations between currencies and explores how understanding the connections between these two can help in reducing risk for traders.

Table of Contents

- What are Currency Correlations?

- Positive and Negative Correlations

- The Importance of Understanding Correlations

- Factors Influencing Currency Correlations

- Using Correlations for Diversification

- Currency Correlations and Technical Analysis

- Limitations of Currency Correlations

- How to Calculate Currency Correlations

- Strategies for Risk Management

- Real-Life Examples of Currency Correlations

- FAQs

- Footnote

What are Currency Correlations?

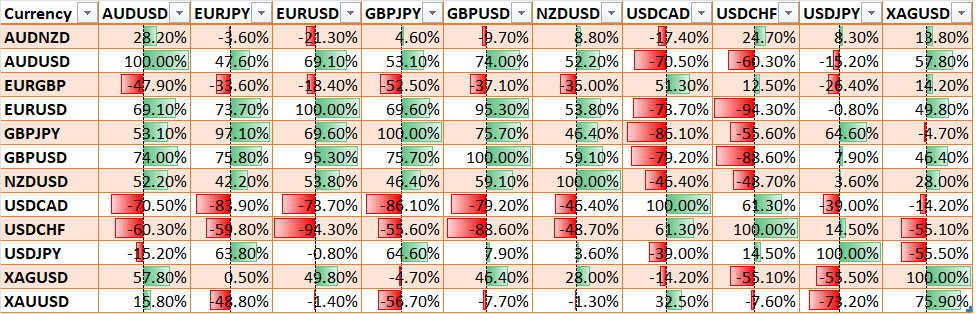

These measures of statistical significance show the connection to two or more pairs. They assist traders in understanding the degree to which pair move together or in the opposing direction. Correlations can be expressed using a scale of -1 to +1. Where -1 indicates a complete negative relationship (when two currencies go entirely in opposing directions) while +1 signifies an absolute positive relationship (when two currencies interact) in contrast to 0 which indicates zero correlation.

Positive and Negative Correlations

Positive correlations indicate that two pairs of currencies will likely move in the same direction. If, for example, EUR/USD and GBP/USD both have positive correlations and are in the same direction, they will be moving up and down. In contrast, the opposite is true. A negative correlation means that the currency pairs are moving in opposing in opposite directions. If EUR/USD and USD/JPY show negative correlations, then when the EUR/USD is rising, USD/JPY could fall while USD/JPY may rise, the reverse is true.

The Importance of Understanding Correlations

Understanding the relationship between currencies is essential in risk management. The traders are able to diversify their portfolios by selecting currency pairs with weak correlations. It allows them to reduce risk by spreading it out and avoiding being excessively exposed to one country or currency. In addition, understanding the correlations can aid to fine-tune trading strategies that are based on the interaction of multiple currencies.

Factors Influencing Currency Correlations

Many factors influence currencies' interactions. The macroeconomic indicators, geopolitical developments, interest rates, and global market sentiment are just a few of the major aspects that affect the movements of currencies and, in turn, their relationships. Being aware of these elements is crucial for investors looking to make informed choices.

Using Correlations for Diversification

Diversification is one of the most fundamental principles of risk management. When diversifying portfolios by using currencies that are weak correlations, investors can absorb the negative impact of markets. This reduces total risk and could help during times that are characterized by increased volatility in the market.

Currency Correlations and Technical Analysis

The correlation between currency pairs can supplement the analysis of technical aspects by offering additional information. For instance, if traders spot a significant technical indication on a certain currency pair, analyzing its relationship with other pairs may confirm or debunk the idea of trading. It can stop traders from taking reckless decisions based only on factors that are technical.

Limitations of Currency Correlations

While correlations between currencies provide useful knowledge, they're also not always constant and fluctuate over the course of time. Changes in geopolitics, economic trends or other unexpected developments could alter the relationships. It is, therefore, essential to periodically review and revise the information on correlations to guarantee the precision of risk-management strategies.

How to Calculate Currency Correlations

The correlation between currencies can be determined with a range of instruments and programs for calculating correlations. The most popular method is to utilize the historical price data to determine the degree to which two currencies interact. Many online platforms and trading programs offer correlation calculations that are easily available to traders.

Strategies for Risk Management

Traders are able to employ various strategies for managing risk that are based on currency correlations. Hedging, diversification, as well as the size of a position are some strategies used to reduce risks in the foreign exchange market. Every strategy comes with benefits and drawbacks. traders should choose a method that best suits their trading style and the risk level they are willing to accept.

Real-Life Examples of Currency Correlations

In order to gain an knowledge of how the currency correlations perform in actual trading scenarios, We will look at a few instances from the real world. Let's look at cases where specific currency pairs showed strong relationships and how traders used this data to reduce risk.

FAQs

Q1: Does the relationship between currency and exchange rates indefinitely change with the course of time?

A: There is no, the currency correlations do not have a fixed time frame and could change due to a variety of influences on the forex market.

Q2: Does understanding currency relationships ensure profits in trading?

A: Although currency-related correlations can provide useful insights, success depends on many aspects, such as good control of risk and successful trading strategies.

Q3: When should investors review their currency-currency correlations?

A: It is advisable to check the currency correlations frequently, at least every day or on a weekly basis. This will allow you to be up-to-date in the ever-changing market conditions.

Q4: Does diversification only that is based on the correlation of currencies enough to manage risk?

A: Although diversification using the correlation between currency pairs is important, it must be combined with other risk-management strategies to achieve the best performance.

Q5 Are currency-related correlations only applicable to the most important currencies?

A: No currency correlations are applicable to every currency pair, whether minor or major. However, major currencies tend to be more often traded and studied.

Q6: Do traders have the ability to use correlations between currencies to help with strategy for trading in the short term?

A: Yes, currency correlations are useful in short- and long-term trading strategies based on the trader's goal and the ability to take risks.

Q7: Can beginners start incorporating currency-related information into their trading strategy?

A: For beginners, it is possible to begin by educating themselves about concepts of correlations and using tools that allow them to analyze and track the relationships between currencies.

Q8 Do currency correlations substitute for technical and fundamental analysis?

A: The currency correlates are best used to complement the fundamental analysis and technical analyses for an informed decision-making process.

Q9: Are there any negatives to making use of currency correlations when trading?

A: One limitation is that correlations may break down during extreme market conditions, leading to unexpected outcomes.

Q10: Do currency correlations be different between trading strategies?

A: Different trading strategies could require currency-related correlations based on specific goals and timings.

Footnote

Correlations between currencies play an important part in forex trading. Being aware of how currencies relate to each other allows traders to make educated decisions and manage risk efficiently. With the help of diversifying their portfolios and implementing appropriate methods for managing risk, traders can navigate the complex Forex market in confidence. Being aware of changes in correlations and remaining up-to-date with developments in the market is vital to continue achieving performance in trading.

Discussion