Central Bank Moves and China's Economic Support: A Preview of What's to Come

As the new week unfolds, investors worldwide are keeping a keen eye on some significant events that could shape the direction of the global markets. Three major central banks - the Federal Reserve, the European Central Bank (ECB), and the Bank of Japan - are expected to announce their latest policy decisions. Additionally, China's Politburo is set to unveil support measures to bolster its economy, which has been facing challenges.

Global Market Sentiment

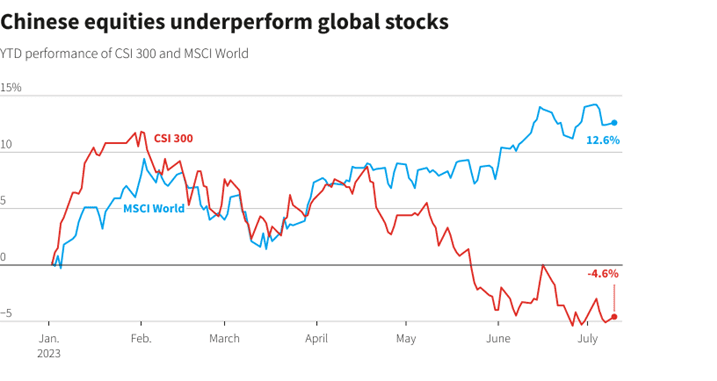

On Monday, market sentiment appeared cautious. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) recorded a slight 0.3% decline. European stock futures and U.S. futures were also relatively flat.

Hong Kong's Hang Seng index (.HSI) stood as an outlier on the downside, experiencing a drop of 1.5%. The decline was attributed to Chinese property developers (.HSMPI), which tumbled over 5%.

Focus on Central Banks

The Federal Reserve and the ECB are expected to implement quarter-point interest rate hikes later this week. Investors are particularly interested in the comments made by Fed Chair Jerome Powell and ECB President Christine Lagarde regarding the future rate outlook. Markets are anticipating this to be the last hike from the Fed and the second-to-last from the ECB, as they prepare for potential rate cuts in the near future.

U.S. Earnings Season and Market Performance

This week will see a surge in U.S. earnings reports from major companies like Meta Platforms (META.O), Microsoft (MSFT.O), and Alphabet (GOOGL.O). The results of these reports will be crucial in justifying the current high earning multiple of the S&P 500, which stands at 20 times, and its year-to-date gains of 19%.

Bank of Japan's Yield Control Policy

The Bank of Japan's upcoming meeting on Friday has garnered attention, with reports suggesting that the central bank is likely to maintain its yield control policy. Policymakers aim to assess more data to ensure continuous wage and inflation growth. As a result, the yen experienced fluctuations, reaching a two-week low of 141.95 per dollar on Friday but stabilizing at 141.36 per dollar in the Asian trading session.

China's Politburo Meeting and Stimulus Measures

Image source form Reuters

Investors are eagerly awaiting China's politburo meeting scheduled for Friday, where major stimulus measures are anticipated. However, in recent days, the government's various agencies have introduced piecemeal support measures for the property sector and consumption, which have not fully impressed the market. Beijing is known for its measured approach to policy changes, and while growth remains on track to meet the government's target of about 5% for the year, some global banks have recently adjusted their forecasts to align with this projection.

Key Developments on Monday:

- Notable earnings releases include Whirlpool, NXP Semiconductors, and Domino's.

- The Chicago Fed National Activity Index will be released.

In summary, this week's market dynamics are set to be influenced by major central bank decisions and China's potential stimulus measures. Investors are closely monitoring economic indicators and corporate earnings reports to gauge the overall health and performance of the global economy. As these events unfold, market participants remain cautious yet hopeful for favorable outcomes.

Discussion