Capital.com Review 2023: A Comprehensive Analysis of Features and Benefits

If you're venturing into the world of online trading, Capital.com could be your ticket to financial success. With over 3,700 markets and a user base of 500,000 registered clients, Capital.com has earned its reputation as a global CFD broker. In this detailed review, we delve into the nitty-gritty of Capital.com, exploring its trading app, investment fees, demo accounts, security measures, and more. By the end, you'll have a clear understanding of the advantages and disadvantages of choosing Capital.com as your trading partner.

Overview Capital.com

Founded in 2016, Capital.com has rapidly grown to accommodate over 70,000 active monthly traders across 180+ countries. The platform witnesses a monthly investment of over $46,000,000 and processes withdrawals totaling $17,000,000.

Capital.com specializes in offering CFDs and derivatives on various financial instruments, including forex pairs, commodities, stocks, and indices. What sets Capital.com apart is its utilization of artificial intelligence-driven analytics to empower traders.

The platform comprises separate entities, each regulated by reputable organizations such as the Cyprus Securities & Exchange Commission (CySEC), the Australian Securities & Investments Commission (ASIC), the Financial Services Authority (FSA), and the UK Financial Conduct Authority (FCA).

Users' reviews on platforms like Wiki, YouTube, Reddit, LinkedIn, Trustpilot, Glassdoor, and others frequently highlight the seamless login process and competitive fees offered by Capital.com.

Trading Platforms:

Capital.com offers an intuitive and user-friendly trading platform. With an emphasis on user experience, the platform provides access to over 75 technical indicators, numerous graphs, charts, and advanced drawing tools. Additionally, traders benefit from features like stop-loss and take-profit orders, as well as negative balance protection.

A standout feature is the 'Discover' function, which allows traders to quickly identify assets with high volume and volatility, along with the biggest gainers and losers. Clicking on an asset opens a live price chart for in-depth analysis.

Transitioning from the web-based platform to the mobile app is seamless, offering comprehensive technical analysis without overwhelming the screen with excessive data. While this simplicity is ideal for CFD beginners, experienced traders can access more detailed tools via MetaTrader 4 (MT4).

MT4 offers a wide array of technical indicators, charting options, and support for automated trading through expert advisors (EAs). However, note that MT4 is not available to clients in the UK. Capital.com also allows account integration with TradingView.

Assets & Markets

Capital.com boasts a diverse selection of markets and asset classes, including:

- 19 commodities

- 128 forex pairs

- 3358 equities

- 181 cryptocurrency CFDs (unavailable to UK traders)

Additionally, clients from the UK and Ireland can take advantage of the spread betting service. While cryptocurrency CFDs are available, they are not accessible to retail clients in the UK.

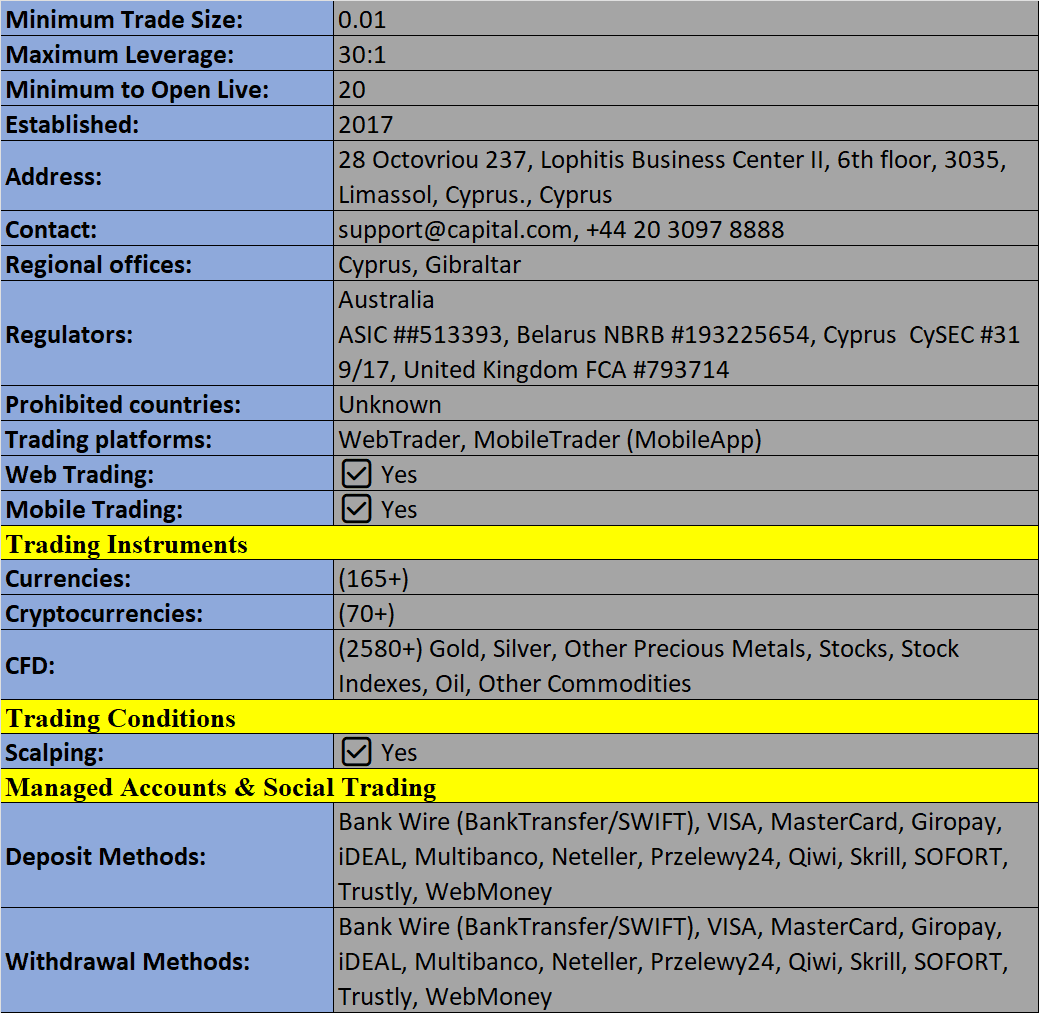

Spreads & Commission

Capital.com offers some of the tightest spreads in the market. For instance, the EUR/USD currency pair features spreads as low as 0.0007 pips, while crude oil spreads are 0.03. The UK100 boasts a spread of 0.9, and the US Tech 100 features a spread of 1.5. Importantly, Capital.com does not charge commissions or fees for deposits, withdrawals, real-time quotes, educational materials, or charting tools, except for overnight fees.

The specific trade costs depend on the market and can be found on the official site.

Leverage and Risk Management

Capital.com fully complies with ESMA's leverage requirements, ensuring a safe trading environment. Leverage opportunities vary by asset class, providing traders with flexibility and risk management options. Additionally, Capital.com implements negative balance protection to prevent traders from incurring losses exceeding their account balance.

Professional accounts are available, but they require proof of investing experience and sufficient capital. It's important to note that professional clients may assume greater risks and enjoy less regulatory protection.

Mobile Apps

Capital.com offers both a web-based platform and a feature-rich mobile application for CFD trading, available for iOS and Android. Users can scan markets, create watchlists, and execute buy and sell orders with ease.

The supplementary app, Investmate, serves as an educational platform, making it an excellent resource for beginners seeking to learn about day trading markets.

Payment Methods

Capital.com provides various payment options, including bank transfers, credit or debit cards, PayPal, Sofort, iDeal, Giropay, Multibanko, Przelewy24, Apple Pay, Trustly, 2c2p, and numerous other popular e-wallets. Clients can open accounts in GBP, EUR, PLN, or USD. Notably, there are no commissions for withdrawals or deposits.

The minimum deposit requirement is set at $20 (via credit card), and the minimum trade size is $1.

Demo Account

Capital.com offers a free demo account, allowing users to test their investment strategies using a $10,000 virtual account. This hands-on experience simulates live trading conditions, helping users make informed decisions before committing real funds.

Regulation and Licensing:

Capital.com is regulated by various authorities, including the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), the Cyprus Securities & Exchange Commission (CySEC), and the Financial Services Authority of Seychelles (FSA).

The FCA-regulated entity, Capital.com UK, adheres to industry standards by segregating bank accounts for brokers and clients. The platform's recognition in reputable publications like The Guardian and City AM further attests to its trustworthiness.

Additional Features:

Capital.com leverages artificial intelligence to provide tailored news feeds, catering to individual preferences. They offer a wealth of educational tools, including the Investmate app, webinars, and access to an economic calendar. Additionally, Capital.com hosts its own TV channel, keeping traders informed about market developments.

Account Types:

Capital.com offers a retail account and a real stocks (Capital.com Invest) account, both without commissions. The retail account allows trading on all assets, while the stock brokerage account exclusively provides access to stocks.

Trading Hours

Capital.com operates 24/7, ensuring accessibility for traders worldwide. However, market opening times vary based on the asset class, so check the website for relevant information.

Customer Support

Capital.com provides round-the-clock support through phone, in-website chat, and messenger. An email inquiry option is also available. The extensive FAQ section on their website covers important points for self-help.

Security and Safety

Capital.com prioritizes security, with rigorous account and identity verification processes. The platform complies with GDPR standards for data processing, ensuring the protection of personal information.

Pros and Cons

Pros:

- Swift registration process

- Versatile deposit and withdrawal methods

- Segregated customer funds

- Abundant training materials and market research tools

- Multilingual support

- Diverse range of trading instruments

Cons:

- Higher initial deposit for retail clients using a card

- Extensive news feed and learning platforms

- Lack of welcome bonuses or sign-up offers

Capital.com stands out as an excellent choice for online investors. Regulated by renowned entities and offering a user-friendly platform with impressive functionality, Capital.com caters to traders of all levels. With a focus on education and actionable insights, it's a platform that helps users learn from their trading experiences and stay updated with relevant news. While it may not suit every trader's preferences, its numerous strengths make it a promising option for those seeking a reliable online brokerage service.

Capital.com Broker Review

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion