Blueberry Markets Review - Regulations, Platforms and Instruments

Blueberry Markets is an Australian forex and CFD broker that has been in operation since 2016. In this comprehensive review, we will cover the key aspects of Blueberry Markets, including its regulations, trading platforms, available instruments, and provide a rating based on its advantages and disadvantages.

What is Blueberry Markets?

Blueberry Markets is an Australian-based broker regulated by ASIC (Australia) and VFSC (Vanuatu). It offers a variety of trading instruments, including forex currency pairs, CFDs on market indices, shares, futures, gold, silver, oil, and cryptocurrencies. The broker caters to different trading styles, including trading robots, scalping, and spike trading, and also provides Copy Trading and managed account services.

Let's dive deeper into the review.

Regulations

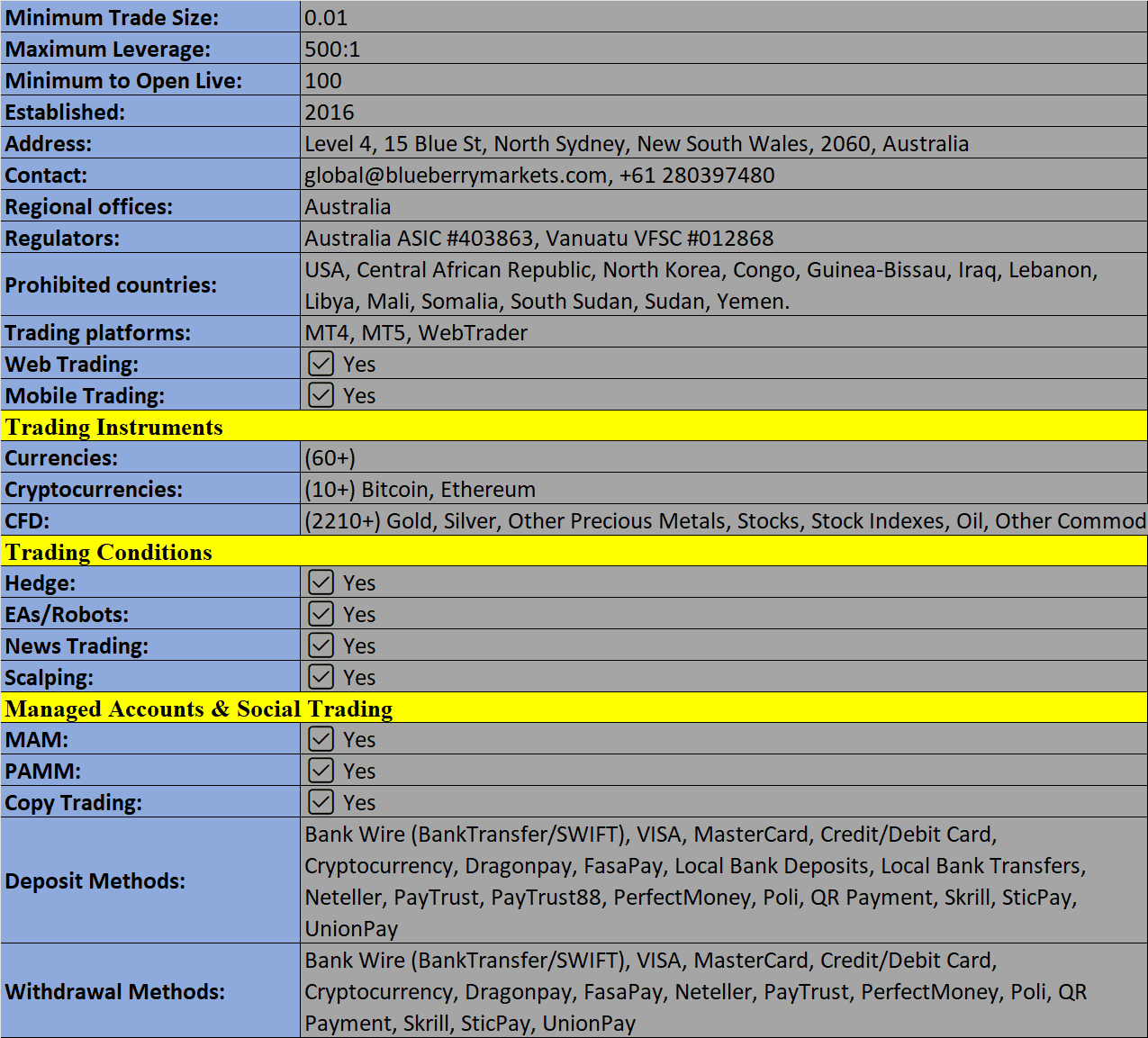

Blueberry Markets is headquartered in Sydney, Australia, and has an offshore branch registered in Vanuatu. The regulatory framework varies depending on your location. International clients typically use the Vanuatu branch, which offers more flexible trading conditions and higher leverage. Australian clients are directed to the locally registered branch, where they have access to a maximum leverage of 1:30 but benefit from stronger Australian regulations.

Trading Instruments

Blueberry Markets offers a diverse range of trading instruments. Notably, it excels in providing access to stocks, with offerings from over 100 US and European companies. Additionally, the broker offers more than 40 forex pairs, major stock indices, and select commodities. All these assets are traded as contracts-for-difference (CFDs), allowing traders to benefit from leveraged exposure to price movements without owning the underlying assets.

Trading Platforms

Blueberry Markets exclusively supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are available as downloadable software for Windows, a Mac version, and a web-based alternative suitable for any computer. The broker also supports MetaTrader mobile apps for Apple and Android smartphones.

Account Types

New Blueberry Markets clients must choose between two account types:

- Blueberry Standard Account: Offers spreads from 1 pip with no commissions.

- Blueberry Direct Account: Features spreads from 0 pips but charges a $7 commission per trade.

Both account types require a minimum deposit of $100 and grant access to the full range of available instruments. Larger account holders may find the Blueberry Direct Account more cost-effective, while newer traders or those with smaller accounts may prefer the Blueberry Standard Account.

Funding Methods

Blueberry Markets offers a variety of funding methods, including bank wire transfers, payment cards like Visa, MasterCard, and China UnionPay, the Australian payment system POLi, and various e-wallets and regional payment options in Indonesia, Thailand, the Philippines, Vietnam, and Malaysia. Cryptocurrency funding is available for most users, excluding those in Australia. Supported cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) on the Ethereum or Tron blockchain. Deposits made using most methods are processed instantly and free of charge.

Advantages of Trading with Blueberry Markets:

- Dual Regulation: Blueberry Markets is regulated in two jurisdictions, holding ASIC and VFSC licenses, providing clients with added security and confidence.

- Diverse Instruments: Traders have access to a wide range of financial instruments, allowing both short and long positions across various markets.

- Trading Platforms: Blueberry Markets supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with access to DupliTrade for copy trading.

- Competitive Spreads: The option to trade with minimal spreads on accounts with a fee per lot is available.

- Free Forecasts: Clients benefit from free forecasts for Forex and popular CFDs.

- High Leverage: Blueberry Markets offers leverage of up to 1:500, providing traders with potential for larger positions.

- Flexible Trading Styles: The broker does not restrict trading techniques, allowing for diverse strategies, copy trading, and expert advisors.

Disadvantages of Blueberry Markets:

- Minimum Deposit: The minimum deposit requirement to start trading with Blueberry Markets is $100.

- No Standard Bonuses: The broker does not offer standard bonus promotions to its clients.

- Cent Accounts: Cent accounts are not available to Blueberry Markets' clients, limiting options for those who prefer lower-stakes trading.

In summary, Blueberry Markets is a competitive player in the forex and CFD trading space, with a strong focus on providing access to stocks and flexible trading conditions. Its dual regulation and support for cryptocurrencies make it an appealing choice for traders looking for a diverse trading experience. However, the minimum deposit requirement and the absence of standard bonuses may not suit all traders.

Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion