Blackwell Global review 2023: Trading Platforms, Instrument Variety Pros and Cons

Hey there, folks! Today, we're diving into the fascinating world of Blackwell Global Group, an award-winning brokerage firm that's been making waves in the trading scene. We'll be covering everything you need to know about this London-based broker, from their regulations and platforms to the benefits and drawbacks of trading with them. So, if you're considering taking the plunge into the trading world, stick around to find out if Blackwell Global is your ticket to success.

Blackwell Global Unveiled

First things first, let's get to know the key players. Blackwell Global Investments (UK) Limited emerged on the scene in 2010 in the United Kingdom. Over the past decade, they've expanded their reach to over 90 countries worldwide, including hotspots like Singapore, China, Thailand, and the Bahamas. Now, that's quite the global footprint!

What sets them apart is their top-notch regulation. Blackwell Global proudly holds a Financial Conduct Authority (FCA) license in the UK and is also regulated by the Cyprus Securities and Exchange Commission (CySEC). Plus, they've set up shop in additional locations across Cyprus, Cambodia, and New Zealand, with a total of nine offices. That's what we call a strong international presence!

Trading Platform

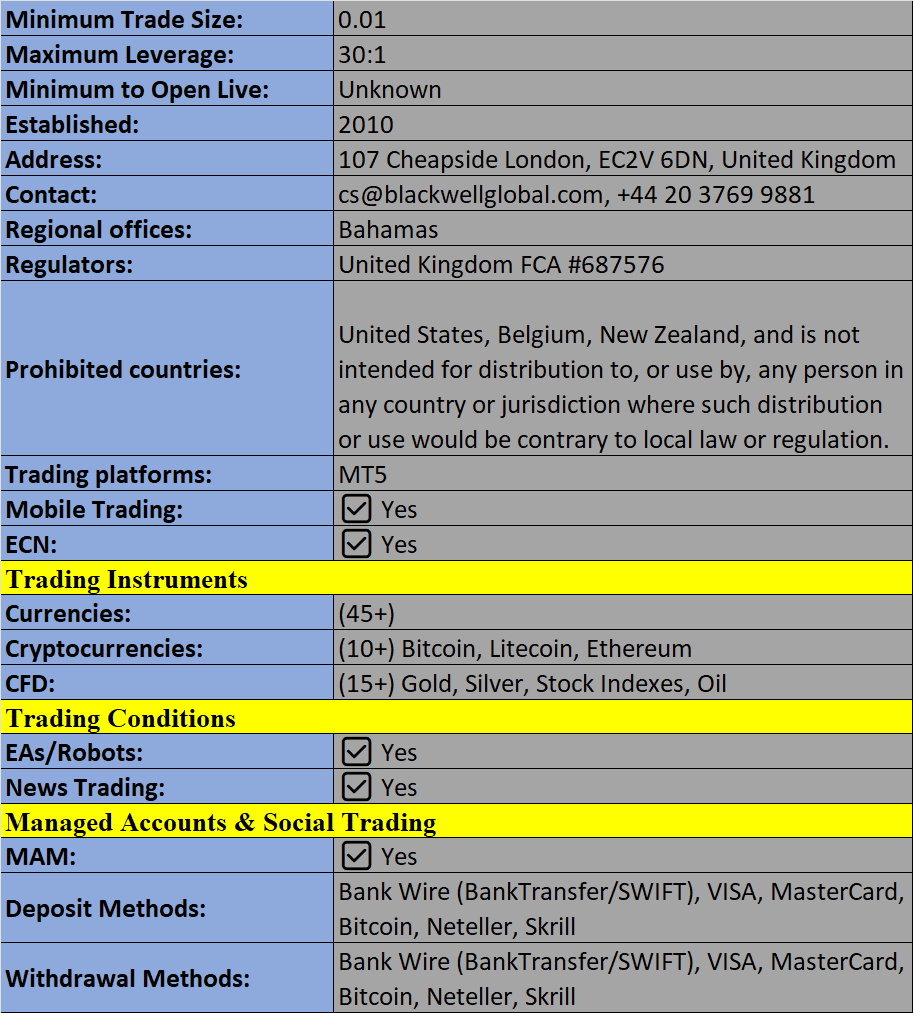

If you're gonna dive into trading, you'll need the right tools. Blackwell Global brings the MetaTrader 4 (MT4) platform to the table. It's not just user-friendly; it's a powerhouse for traders of all levels. With support for over 20 languages, this platform is designed to cater to a global audience.

Once you're in, brace yourself for an advanced charting package with over 30 technical analysis indicators. These charts are like digital canvases, fully customizable to display multiple graphs on one screen. And here's the kicker: you also get access to trading robots, back-testing within their historical database, hedging functions, and automatic updates and alerts. It's a one-stop-shop for traders looking to up their game.

Trading Instrument

You know what's exciting? Having a variety of assets to trade. Blackwell Global offers a smorgasbord of options:

- Forex: They've got 47 currency pairs, including heavyweights like EUR/USD and GBP/EUR.

- Indices: Choose from 12 CFD indices, including the iconic FTSE 100 and NASDAQ.

- Cryptocurrencies: Dive into 16 different coins, including Bitcoin and Ripple.

- Commodities: They've got your precious metals and oils, including gold and silver.

With this selection, you can create a diversified portfolio that suits your trading style.

Spreads & Commissions

When it comes to spreads, Blackwell Global offers a range of options. If you're into ECN spreads, you can start as low as 0.7 pips for EUR/USD. Standard spreads are still competitive, hovering around 1.8 pips for the same pair. For indices like the FTSE 100, ECN spreads are as tight as 1.4 pips, while standard spreads are at 2 pips.

The good news is there are no commissions charged with the standard account. However, if you opt for the ECN account, you'll be looking at a $4.50 commission per lot in each direction. Keep in mind that there's an inactivity fee of $25 per month after six months of account dormancy, but don't worry, they're open to discussions on this front. Also, daily financing costs (swaps) apply if you keep positions open overnight.

Leverage

Leverage can be your best friend or your worst enemy in the trading world. Retail clients at Blackwell Global can access leverage up to 1:30, while professional clients can request higher leverage, subject to approval. It's a double-edged sword, as it can magnify your gains but also your losses, so use it wisely!

Mobile Application

In our fast-paced world, you need to stay connected to the markets. Blackwell Global's got your back with the MT4 mobile app, available in ten languages. You can stream live forex quotes, access historical and real-time trading data, and keep an eye on your open positions and pending orders. It's like having a trading desk in your pocket!

Payment Methods

Money talks, right? Blackwell Global offers a decent range of funding methods in USD, EUR, GBP, and CHF. You can use bank transfers, credit/debit cards, or e-wallets to make your deposits. The minimum deposit requirement is $250, and remember, bank charges may apply for international bank transfers, which can take up to five days. But the good news is that all other methods are processed instantly and are fee-free. Quick and easy, just how we like it!

Demo Account

Newbies, rejoice! Blackwell Global offers a 30-day demo account that's a playground for practicing your trading skills. It replicates the live trading environment and comes with a real-time data stream. You start with virtual funds of 10,000 in your chosen currency, but if you need more play money, just ask. When you're ready to take the plunge, upgrading to a live account is a breeze.

Regulations:

Security and trust are essential in the trading world. Blackwell Global takes regulation seriously. They are authorized and regulated by the FCA with FSRN 687576 and the CySEC. In Hong Kong, they hold an asset management license with the Securities and Futures Commission. These strict regulations mean they have to meet high standards, including providing annual reports to external auditors. Plus, they keep company funds and client funds in separate accounts with reputable banks, like Barclays. And there's more good news: your funds are protected by the Financial Services Compensation Scheme (FSCS), insuring up to £85,000 per client. They also offer negative balance protection to retail clients. So, if Blackwell Global ever plays foul, they're in for a world of trouble.

Additional Features

Blackwell Global doesn't just stop at trading; they've got some cool extras. You can find educational guides, e-books, and training articles on various trading topics, including forex, MT4 indicators, and technical analysis. They even offer free webinars through the Trading Bootcamp, so you can level up your skills. And if you're a news junkie, their research center has the latest market news and analysis.

Account Types

When you sign up with Blackwell Global, you get to choose from four account types: Standard, ECN, Pro, or Islamic. The minimum deposit for the Standard and ECN accounts is $250, which might be a tad high for beginners, but the trade-off is low spreads in the ECN account and commission-free trading in the Standard account. The minimum trade size is 0.01 lots, and all available instruments are up for grabs in both accounts. Professional traders who meet the requirements can enjoy higher leverage, a personal account manager, and superior execution where available. And for those who need it, they offer Islamic (swap-free) accounts upon request.

Trading Hours

Don't you hate it when you're ready to trade, but the market's asleep? Not with Blackwell Global. The MT4 server has specific asset trading sessions, which you can access once you sign in to the platform. Commodities are up for grabs 23 hours a day, five days a week, and cryptocurrencies never sleep, available 24/7. Server times are provided in GMT+2 (+3 during daylight saving time), so you can always keep track of the action.

Customer Support

Blackwell Global offers multilingual support in over 10 languages, including English, Arabic, Chinese, French, and Korean. You can reach out to them by filling in the enquiry form or calling +44 20 3769 9881. And if you're more of a chat person, they've got a live chat service that's helpful and responsive, as we found out during testing.

Safety and Security Measures

Your data and financial info are in good hands with Blackwell Global. They use robust security systems on both the MT4 platform and the Infinitum back-office platform. That includes encryption technology to safeguard data exchange and secure login procedures. All transactions are managed internally via the client portal, so you can trade with peace of mind.

The Verdict

So, what's the final word on Blackwell Global? It's an FCA-regulated broker that caters to both retail and professional clients. You get the perks of ECN and demo accounts, but keep in mind that the $250 minimum deposit might not be ideal for newbies. It'd be nice to see stocks and shares trading added to their assets, but for now, they've got a lot going for them.

Advantages and Limitations

Advantages

In our review, we discovered some pretty nifty advantages to trading with Blackwell Global:

- MT4 Accelerator & Trading Diary

- Multiple regulated entities

- Commission-free trading

- ECN account

Limitations

Of course, there are a few limitations to choosing this broker:

- $250 minimum deposit

- Limited choice of platforms

- Not open to US clients

- No stocks and shares

So, there you have it, the lowdown on Blackwell Global. If you're looking for a regulated broker with a bunch of cool features, they might just be your ticket to the trading world. Happy trading, folks!

Blackwell Global Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion