BDSwiss Review 2023: Trading Platforms, Instrument Variety, Pros, and Cons

BDSwiss stands as a beacon among competitors, boasting an impressive 1 million client trading accounts. This review delves into the intricacies of their services, aiming to facilitate informed comparisons within the realm of similar brokers.

Trading Platform:

Upon entering the BDSwiss platform, users encounter a default English setting. However, international clients enjoy the flexibility of navigating the site in diverse languages, catering to individual preferences. Registering for an account is a breeze, consuming less than a minute of your time, facilitating quick entry into the trading sphere.

The platform's layout bears minimal discrepancies between the two BDSwiss sites. Notably, the European site diverges by omitting the Wealth Management option. Navigation across both websites remains effortless, offering accessibility even for novice traders. The BDSwiss main site and its European counterpart house the Trading Academy, catering to newcomers. Furthermore, initiating a Demo trading account mandates direct communication with an advisor to acquire €10,000 in demo trading funds.

Streamlined Trading Experience and Robust Support

BDSwiss extends the opportunity to trade in CFDs or forex, presenting a lucid and succinct trading process. The site accommodates MetaTrader (MT4) trading, supplemented by comprehensive training resources. Alternatively, traders may opt for the BDSwiss WebTrader platform for their transactions.

Delving deeper into their website, a plethora of resources awaits exploration. Regular trader webinars, video courses, and a rich repository of educational materials cater to traders across all proficiency levels. The inclusion of on-site quizzes serves as an invaluable tool, evaluating trading knowledge and affirming readiness for live trading.

Extensive Currency Pair Choices

For those delving into the forex markets, BDSwiss presents an extensive selection of currency pairs. Traders can choose from major currency pair CFDs, minor currencies, and even exotic pairs. With over 50 currency pairings available, BDSwiss ensures ample options to suit different trading strategies.

Commodity CFDs: Gold, Natural Gas, Oil, and Beyond

With more than five commodity CFDs including gold, natural gas, and oil, BDSwiss provides a gateway to the world of commodities trading. These offerings empower traders to diversify their portfolios and explore opportunities beyond traditional markets.

Equity Pairs and Stock Exchanges

BDSwiss caters to equity traders with access to over 140 equity pairs sourced from four of the most renowned international stock exchanges. This breadth of options allows investors to delve into global markets and capitalize on diverse opportunities.

Indices and Cryptocurrencies: Additional Choices

The platform also encompasses various indices and cryptocurrency pairings, further broadening the spectrum of tradable assets available at BDSwiss. This diversity enables investors to explore emerging markets and capitalize on the growing significance of digital currencies.

Understanding Forex Trading Dynamics

Forex trading at BDSwiss provides a window into the dynamic world of currency fluctuations and market movements. Consider a simple scenario involving a popular currency pair like EUR/USD. If quoted at 1.10 for the EUR/USD pair, it signifies the exchange of 1.10 US dollars for 1 euro.

Should the price shift to 1.20, indicating a weaker dollar against the euro, traders who initiated a buy position on euros stand to profit from this fluctuation. The essence of forex trading lies in predicting these currency fluctuations to capitalize on buying or selling opportunities.

Discover more insights into trading forex and CFDs by exploring our website.

Insight into Spreads, Commissions, and Account Types

Spread Dynamics in Trading

Assets like Forex pairs and indices are characterized by spreads, denoting the variance between the bid and ask prices. At BDSwiss, diverse assets feature distinct spread values, evaluated through pip values. These spreads, which incorporate trading fees, fluctuate based on market conditions and volatility.

Fee Structures and Commissions

Most trades on BDSwiss do not incur direct trading fees or commissions. Instead, trading fees are embedded within spreads. However, nominal commissions (0.1%) apply to stock CFD trades and rollover trades conducted over subsequent days.

Account Types and Spread Variations

BDSwiss offers different account types, each presenting varying average spreads. The Basic and RAW accounts are among the choices, with the RAW spread account being the preferred option, despite the inclusion of commission charges.

Leverage Options: Enhancing Trading Potential

Leveraging Opportunities at BDSwiss

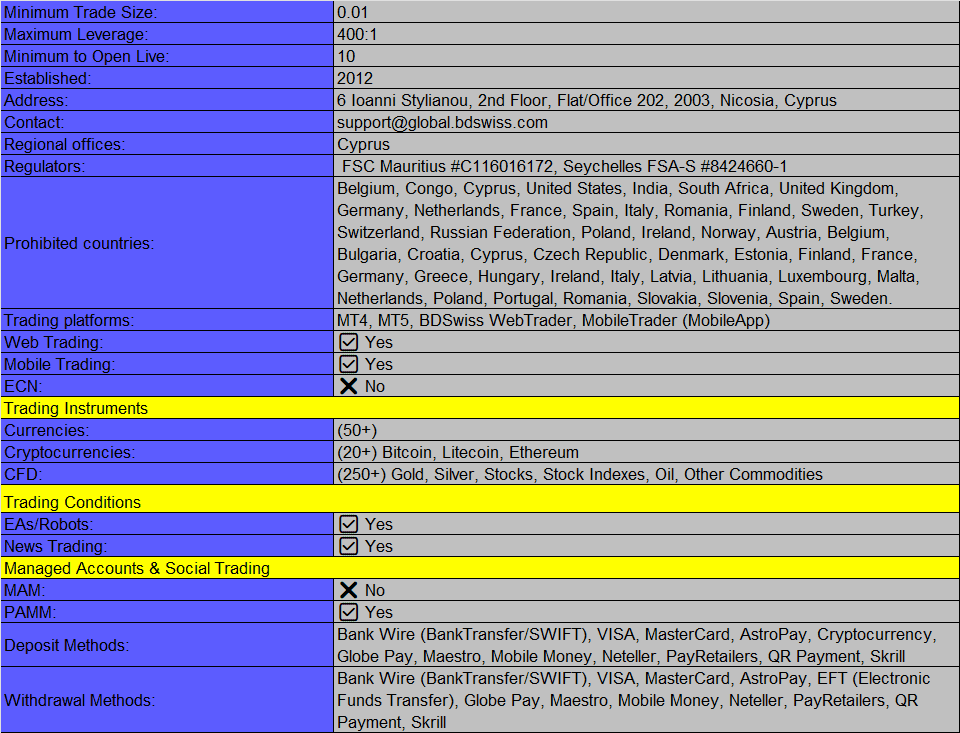

Traders opting for BDSwiss gain access to enhanced leverage, amplifying their trading capabilities. For instance, major forex pairings can be leveraged at an impressive ratio of 1:400, while commodities offer leverage at 1:300, providing traders with greater potential for amplified returns.

Leverage Limitations Based on Platforms

Notably, choosing the European platform entails adherence to leverage limits set by the European Securities and Markets Authority (ESMA). This translates to capped leverage ratios, such as 1:30 for forex pairs and 1:2 for cryptocurrencies.

Dive into BDSwiss’ diverse asset markets today to explore a world of trading opportunities tailored to your investment preferences and strategies.

BDSwiss Mobile Apps

Enhance your trading experience with BDSwiss through their versatile mobile apps. Accessible via the Apple App Store and Google Play, these apps enable seamless trading on-the-go. Additionally, the BDSwiss Web Trader provides a hassle-free option accessible through your Facebook or Google accounts. Whether on your smartphone or tablet, all asset classes are conveniently available on the BDSwiss mobile platform.

Diverse Payment Methods for Your Convenience

When initiating your BDSwiss account, choose your preferred trading currency from options including UK £, US $, Euros, Danish Kr, or Swiss CHF. Deposit and withdrawal methods are diverse, encompassing bank transfers, credit or debit cards, Skrill, and Sofortüberweisung (Sofort).

There are no constraints on cash amounts for deposits or withdrawals. However, note that bank transfers under EUR 100 incur a EUR 10 fee, and the minimum withdrawal via bank wire is EUR 50, inclusive of the EUR 10 fee.

Demo Account

Acquaint yourself with the BDSwiss platform via their Demo account. Activation of the Forex/CFD demo account requires direct interaction with an adviser.

Trading Opportunities

While BDSwiss doesn’t present specific deals or promotions on their platform, traders benefit from invaluable trading alerts. Moreover, their educational resources, including free seminars, serve as valuable assets for clients seeking to augment their financial knowledge.

Regulatory Insights

For comprehensive details on regulators and licenses, visit the BDSwiss website.

Additional Features

BDSwiss continually enriches its asset listings, although it may not encompass as broad a range as some major competitors. Noteworthy among its features are interactive seminars, providing traders with professional insights across various trading domains. Registering interest in any listed webinar grants access to these enriching sessions.

Boasting spreads commencing at 1 pip and leverage up to 400 times your cash investment, BDSwiss emerges as a serious consideration for traders.

Understanding Account Types

BDSwiss offers diverse account types catering to different trader preferences. These include the Classic Account for retail traders, the VIP account boasting reduced spreads, and the Raw account, which presents even tighter spreads and remains a popular choice among users.

Benefits accompanying each account type vary, with features like VIP access, charting tools, and account manager availability contingent upon the account type or deposit size. It's important to note that the BDSwiss Islamic account is unavailable with the Raw account type.

Optimize your trading experience with BDSwiss by exploring these varied features and account options tailored to diverse trading needs.

Trading Hours:

Upon opening a BDSwiss account, users gain access to comprehensive information regarding the trading hours for various assets through the Market Overview section on the platform.

Contact Details/Customer Support:

For customer support, BDSwiss offers Live Chat availability from 09:00 to 23:30 five days a week. Alternatively, users can reach out via email using the contact form or at support@global.bdswiss.com. Telephone numbers for various countries are listed on their website, catering to clients who prefer direct communication for issue resolution.

Safety And Security:

Prioritizing client safety and security against fraud, BDSwiss mandates proof of identity from all new clients before granting platform access. Accounts are safeguarded by passwords, and BDSwiss ensures encryption and confidentiality of all customer details, prohibiting third-party access to client data.

Overall Verdict:

BDSwiss platforms present an extensive range of equities and commodities for traders. The platforms offer a user-friendly interface, augmented by informative trader seminars, beneficial for those keen on enhancing their day trading knowledge. Notably, the platform provides a useful charting function allowing traders to customize indicators according to their preferences, aiding in efficient decision-making. For Forex traders, the platform offers an array of advanced features for technical analysis.

Pros and Cons

Pros:

- Multiple reliable trading platforms including MT4, MT5, WebTrader, and an in-house app

- Knowledgeable support team available 24/5 in 20 languages

- Four trading accounts catering to diverse traders and budgets

- Comprehensive beginner education including webinars

- Excellent market research with daily insights

- Wide instrument range including crypto

- Quick and simple account opening process

Cons:

- $30 inactivity fee after 90 days

- Unavailability of services for US & UK traders

BDSwiss Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion