Automating Wealth: How Robo-Advisors Are Transforming Investments

Introduction

In the era of rapid technological advancements, the financial world has witnessed a remarkable transformation with the emergence of robo-advisors. These automated investment platforms have revolutionized wealth management by making it accessible to the masses. In this article, we will delve into the rise of robo-advisors, their working principles, advantages, and their potential impact on the future of investments.

Table content

1. The Evolution of Wealth Management

2. What are Robo-Advisors?

3. How Robo-Advisors Work

4. Advantages of Robo-Advisors

5. Robo-Advisors vs. Traditional Financial Advisors

6. The Future of Robo-Advisors

7. Footnote

8. FAQs (Frequently Asked Questions)

The Evolution of Wealth Management

Before diving into the intricacies of robo-advisors, let's first understand the evolution of wealth management. Traditional investment practices often required considerable capital, professional expertise, and human interactions with financial advisors. However, the digital revolution paved the way for a new era of automated investment solutions – the robo-advisors.

What are Robo-Advisors?

Robo-advisors are digital platforms that leverage artificial intelligence and algorithms to provide automated investment advice and portfolio management. They use complex algorithms to analyze various factors such as risk tolerance, financial goals, and time horizon to create personalized investment portfolios for individual investors.

How Robo-Advisors Work

- Data Gathering and Analysis: The process begins with investors providing essential information about their financial situation, goals, and risk tolerance. Robo-advisors analyze this data to understand the investor's profile.

- Portfolio Recommendations: Based on the analysis, the robo-advisor recommends a tailored investment portfolio, which typically comprises a mix of stocks, bonds, and other assets.

- Automated Rebalancing: As market conditions change, the robo-advisor automatically rebalances the portfolio to maintain the desired asset allocation.

- Tax Optimization: Some advanced robo-advisors offer tax-efficient strategies, minimizing tax liabilities for investors.

Advantages of Robo-Advisors

Robo-advisors bring numerous benefits to the world of investments:

- Accessibility: Robo-advisors have significantly lowered the barrier to entry for investing, allowing even small investors to access professional-grade wealth management.

- Cost-Effectiveness: Traditional financial advisors often charge high fees, while robo-advisors offer competitive and transparent pricing structures.

- Diversification: Robo-advisors build diversified portfolios, reducing the impact of individual stock fluctuations on the overall investment.

- Automation: The automated nature of robo-advisors frees investors from the need to monitor the market constantly.

- Personalization: Robo-advisors tailor investment strategies according to the individual investor's financial goals and risk tolerance.

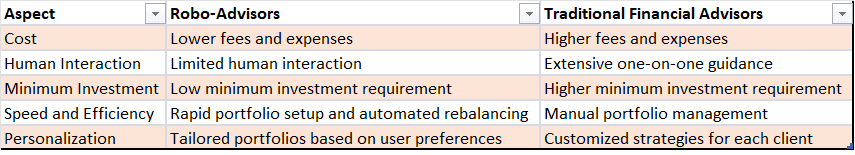

Robo-Advisors vs. Traditional Financial Advisors

The Future of Robo-Advisors

Robo-advisors have already made a significant impact, but their journey has only just begun. As technology continues to advance, we can expect several developments in the robo-advisory space:

- Artificial Intelligence Advancements: Robo-advisors will become more sophisticated with advancements in AI, enabling them to provide even more personalized and precise investment advice.

- Integration with Blockchain: Blockchain technology could enhance the security and transparency of robo-advisory platforms.

- Expansion into New Markets: Robo-advisors may expand their services to cater to specialized investment needs and niche markets.

- Hybrid Models: Some companies might adopt hybrid models, combining robo-advisory services with human financial advisors to offer the best of both worlds.

Footnote

The rise of robo-advisors has transformed the landscape of wealth management, making it accessible, affordable, and efficient for investors of all backgrounds. These automated platforms have proven to be a game-changer by combining cutting-edge technology with investment expertise. As the fintech industry continues to evolve, robo-advisors are set to play a pivotal role in shaping the future of investments.

FAQs (Frequently Asked Questions)

- Are Robo-Advisors Safe to Use?

- Robo-advisors employ robust security measures to protect user data and transactions. However, investors should choose reputable platforms with proper security certifications.

- Can Robo-Advisors Outperform Human Financial Advisors?

- While robo-advisors offer cost-effective and consistent portfolio management, some investors still prefer the personalized touch of human advisors.

- Do Robo-Advisors Consider Ethical Investing?

- Yes, some robo-advisors offer options for ethical investing, taking into account environmental, social, and governance (ESG) criteria.

- How Often Do Robo-Advisors Rebalance Portfolios?

- Robo-advisors typically rebalance portfolios periodically or when significant changes occur in the market, ensuring the asset allocation stays on track.

- Can I Trust Robo-Advisors with Large Investments?

- Robo-advisors have proven to be reliable for managing investments of varying sizes. However, for substantial investments, some investors may still prefer direct human oversight.

Discussion