ATC Brokers: A Comprehensive Overview of Regulations, Platforms, Trading Instruments, Pros, and Cons

Are you considering ATC Brokers Ltd as your forex trading partner? Before you dive in, let's take a detailed look at what this broker has to offer in terms of regulations, trading platforms, instruments, as well as its strengths and weaknesses.

ATC Brokers Overview

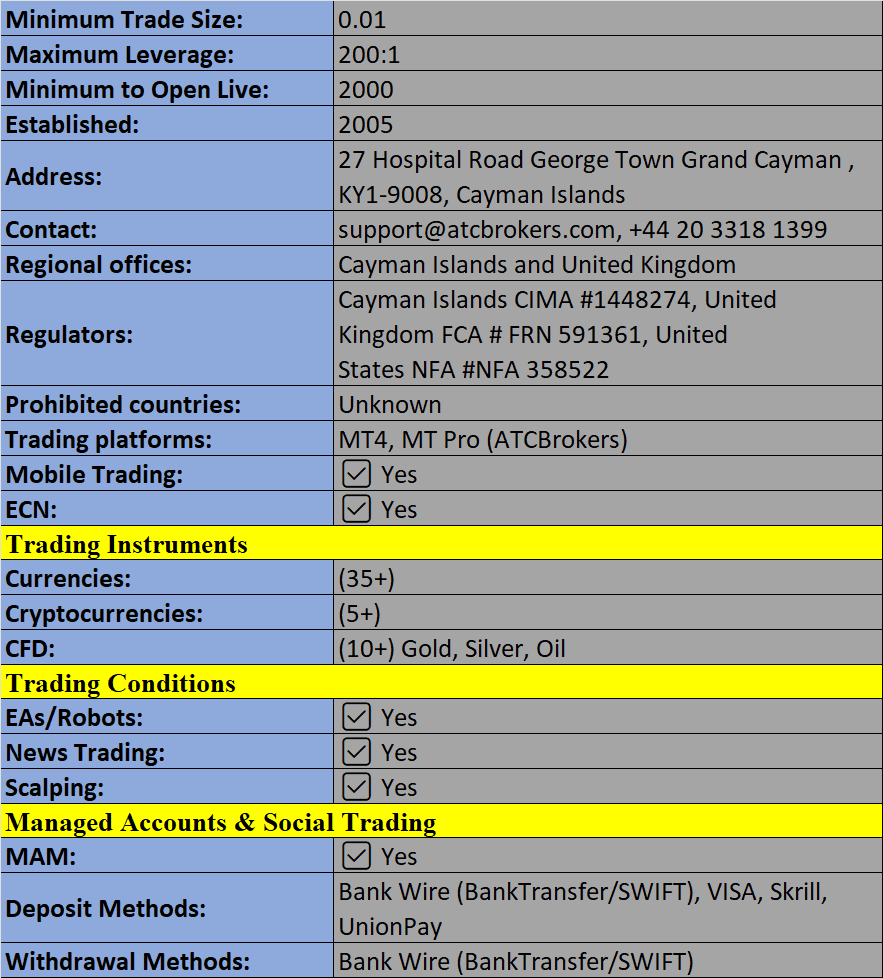

Established in 2012 and headquartered in London, ATC Brokers Ltd operates under the regulation of the Financial Conduct Authority (FCA) in the United Kingdom. Additionally, it maintains an entity in the Cayman Islands, which is governed by the Cayman Islands Monetary Authority (CIMA). ATC Brokers follows an STP (Straight Through Processing) model, ensuring swift execution through top-tier liquidity providers. Their offerings cater to both novice traders and institutional clients.

Trading Platform: MT Pro (MetaTrader)

ATC Brokers provides access to the MT Pro platform, an enhanced version of the popular MetaTrader 4 (MT4). MT Pro offers a host of advanced features, allowing traders to tailor orders with comprehensive risk management tools such as bracket orders, trailing stops, and strategy orders. It also generates detailed trading reports, including profit and loss analysis, winners and losers data, performance statistics, and time-based analysis. Traders benefit from Depth of Market view, customizable charting layouts, and access to EA signals and automated trading.

Markets Available

ATC Brokers offers a diverse array of trading options. You can choose from over 35 currency pairs, ranging from major to exotic options, as well as CFD indices like the Dow Jones and S&P 500. Commodities such as oils, gold, and silver are also available. However, it's important to note that cryptocurrency trading is not supported by this broker.

Spreads and Commissions

Competitive ECN spreads are a highlight, with average spreads on currency pairs like EUR/USD starting from as low as 0.3 pips. Spreads for silver are at 0.7 pips, and major indices like the FTSE 100 come in at around 0.6 pips. Commissions are set at $0.60 round turn for mini contracts (10,000 lot size) and $6.00 round turn for standard contracts (100,000 lot size). Additionally, dormant account fees and rollover fees are applicable.

Leverage

ATC Brokers offers varying leverage options. For major currency pairs, leverage is set at 1:30, while non-major currency pairs, gold, and major indices have a leverage of 1:20. Silver and other commodities offer 1:10 leverage. Professional traders may apply for a higher leverage of 1:100, with detailed margin calculations available in the FAQ section.

Mobile Apps

The MetaTrader 4 trading platform is accessible via a free downloadable mobile app from the App Store or Google Play. This app facilitates complete account management, real-time data access, financial news updates, and includes 30 pre-loaded technical indicators for market analysis.

Payment Methods

Deposits and withdrawals can be made through bank wire, Visa, MasterCard, Skrill, and Union Pay, with support for USD, EUR, and GBP currencies. Bank wire deposits are fee-free, while debit/credit card and Skrill transactions incur a 2.9% fee. Withdrawal fees vary, with options for international bank wire, faster payment (UK only), and Skrill. Credit/debit card withdrawals are fee-free and typically processed within 1 – 2 business days.

Demo Account

ATC Brokers provides a 60-day demo account, enabling traders to practice in a risk-free environment with access to live market pricing and simulated trades before transitioning to a real-money trading account.

Regulation and Security

ATC Brokers Ltd is regulated by the FCA in the UK (FRN 591361) and CIMA in the Cayman Islands (License Number 1448274). These regulatory bodies impose strict standards and safeguards for client protection, including the segregation of client funds. ATC Brokers utilizes Barclays and NatWest for account custodian services. UK clients are also covered by the Financial Services Compensation Scheme (FSCS), offering protection up to £85,000 per person.

Additional Features

ATC Brokers offers educational content on forex and CFD trading basics, an economic calendar to track global news, and daily market news updates. While these resources are valuable, they may not stand out as particularly unique or extensive.

Account Types

Clients have the flexibility to open individual, joint, or corporate ECN accounts with narrow spreads and leverage up to 1:30 for individuals and 1:100 for professional traders. The minimum lot size is 0.01, and there is no maximum trade size. The account primarily targets experienced traders, given the minimum initial deposit requirement of $5,000 USD or its equivalent in GBP or EUR. Custom money management solutions like PAMM accounts are also available upon request.

Trading Hours

The FX market operates from Sunday 5:05 PM EST to Friday 4:59 PM EST, with variations during holiday schedules. The metals market opens at 6:00 PM EST on Sundays, closes at 5:00 PM EST on weekdays, and reopens at 6:00 PM EST. Fridays close at 5:00 PM EST and reopen on Sundays. For specific trading hours of other assets, consult the contract specifications.

Customer Support

ATC Brokers offers multiple contact options, including email (support@atcbrokers.com), telephone (+44 20 3318 1399), and live chat support. Their headquarters are situated at 1 Fore Street Avenue, London, EC2Y 9DT.

Security

MT Pro (MT4) adheres to industry-standard security protocols and employs 128-bit encryption. Traders also have the option to enhance security by enabling email and phone authentication during login.

Advantages of ATC Brokers:

- Competitive spreads starting from 0.3 pips for EUR/USD.

- Availability of Trade Copier and PAMM accounts.

- Support for 38 Forex currency pairs.

- Regulation by reputable authorities in the USA and the UK.

- Access to liquidity providers through ECN and STP technologies.

Disadvantages of ATC Brokers:

- Limited choice of trading instruments.

- Fees for account funding, withdrawals, and inactivity.

- Absence of bonus offerings.

ATC Brokers earns positive marks for its narrow ECN spreads, FCA regulation, robust trading platforms, and the availability of a 60-day demo account. However, the $5,000 minimum deposit requirement may pose a barrier for casual traders and beginners. This broker is best suited for experienced traders looking for competitive trading conditions and regulatory compliance.

ATC Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion