Admiral Markets Review: A Comprehensive Broker Analysis

Admiral Markets, now rebranded as Admirals since 2021, has been a prominent player in the world of Contracts for Difference (CFD) trading since its establishment in 2001. With a strong regulatory presence from ASIC (Australia), FCA (UK), CySEC (Cyprus), EFSA (Estonia), FSA-S (Seychelles), and JSC (Jordan), this broker offers access to a diverse range of financial instruments, making it a versatile choice for traders.

Key Highlights:

- Wide Range of Instruments: Admirals impresses with its offering of over 8000 CFD instruments spanning Forex, Indices, Commodities, Shares, ETFs, and Bonds, catering to the varied preferences of traders.

- Robust Trading Platforms: The broker provides a selection of trading platforms, including MetaTrader 4, MetaTrader 5, a proprietary mobile platform, and a customized Supreme Edition of MetaTrader 4 and 5. The Supreme Edition enhances the trading experience with extra features like Trading Central feed, sentiment analysis, news, advanced trading terminals, a simulator, and a comprehensive indicator package.

- Valuable Tools: Admirals equips traders with a set of valuable tools, including Volatility Protection Settings, the StereoTrader panel for MetaTrader, VPS service, and Parallels licenses for Mac users, enhancing the trading environment.

- Educational Resources: The Admirals website stands out for its educational materials, market updates, heat maps, sentiment analysis, podcasts, and trading calculators. This comprehensive educational suite makes it suitable for traders of all skill levels.

- Client-Focused Services: Cyprus-based clients can take advantage of a VISA card linked to their trading account and the Admiral Wallet app, adding convenience and accessibility to their trading experience.

Who Should Consider Admirals?

Admirals is well-suited for both novice and experienced traders:

- Novices: Admirals' "Zero to Hero" course and extensive educational resources are tailored to help beginners understand the market and gain confidence in trading.

- Experienced Traders: The broker's advanced software offerings, including MetaTrader 4 and 5, cater to seasoned professionals. Admirals' reputation for reliability, reinforced by robust regulation, makes it a preferred choice for experienced traders.

Key Features:

- Stringent Regulation: Admirals' extensive regulation, spanning various jurisdictions, provides a solid foundation for trust and reliability, assuring traders of their commitment to compliance.

- Advanced Trading Tools: The MetaTrader Supreme Edition, unique to Admirals, offers more than fifty additional features not found in standard MetaTrader 4 and 5 platforms, enhancing trading capabilities.

- Flexible Account Options: Admirals offers a range of trading accounts tailored to MetaTrader 4 and MetaTrader 5 users, allowing traders to choose accounts that align with their preferences and trading styles.

- Competitive Spreads: Low spreads, starting from 0-0.5 pips, are a notable advantage, especially for active traders seeking cost-effective trading opportunities.

- Low Commissions: Admirals maintains low commission fees, which vary by market. Transparent commission tables on the website aid traders in understanding costs.

Advantages of trading with Admiral Markets UK:

- Diverse Asset Selection: With over 5,000 trading assets, including stock assets traded on exchange markets, Admirals provides ample options for diversification.

- Innovative Features: Admirals offers its proprietary social trading platform for copy trading, as well as the Supreme Edition plug-in for MetaTrader 4 and 5, expanding technical and chart functionality.

- Reputable Regulatory Oversight: Admirals holds licenses from FCA and CySEC, two of the most respected regulatory bodies in the industry, offering traders added security.

- Risk Management and Insurance: The broker provides risk management solutions and compensation fund coverage of up to €20,000 per trader, enhancing trader protection.

- Comprehensive Support: Admirals offers dedicated support and premium analytics, ensuring traders receive assistance and insights when needed.

- Islamic Account Option: Swap-free Islamic accounts are available for traders who require adherence to Shariah principles.

- Demo Accounts: Free demo accounts enable traders to practice and test strategies without risking real capital.

Disadvantages of Admiral Markets UK:

- Leverage Restrictions: Retail traders without "professional" status may face limitations on leverage, in compliance with regulatory requirements.

- Withdrawal Fees: Admirals charges withdrawal fees, which can be a drawback for traders who frequently move funds.

- No Fixed Spread Accounts: Admirals does not offer fixed spread accounts, which may not suit traders with specific spread preferences.

Admirals is a well-established and highly regulated CFD broker that caters to a wide range of traders. Its comprehensive offering of instruments, advanced trading tools, and commitment to education make it a competitive choice in the trading industry. While some drawbacks exist, the overall package of services and features makes Admirals a strong contender for traders seeking a reliable and versatile trading platform.

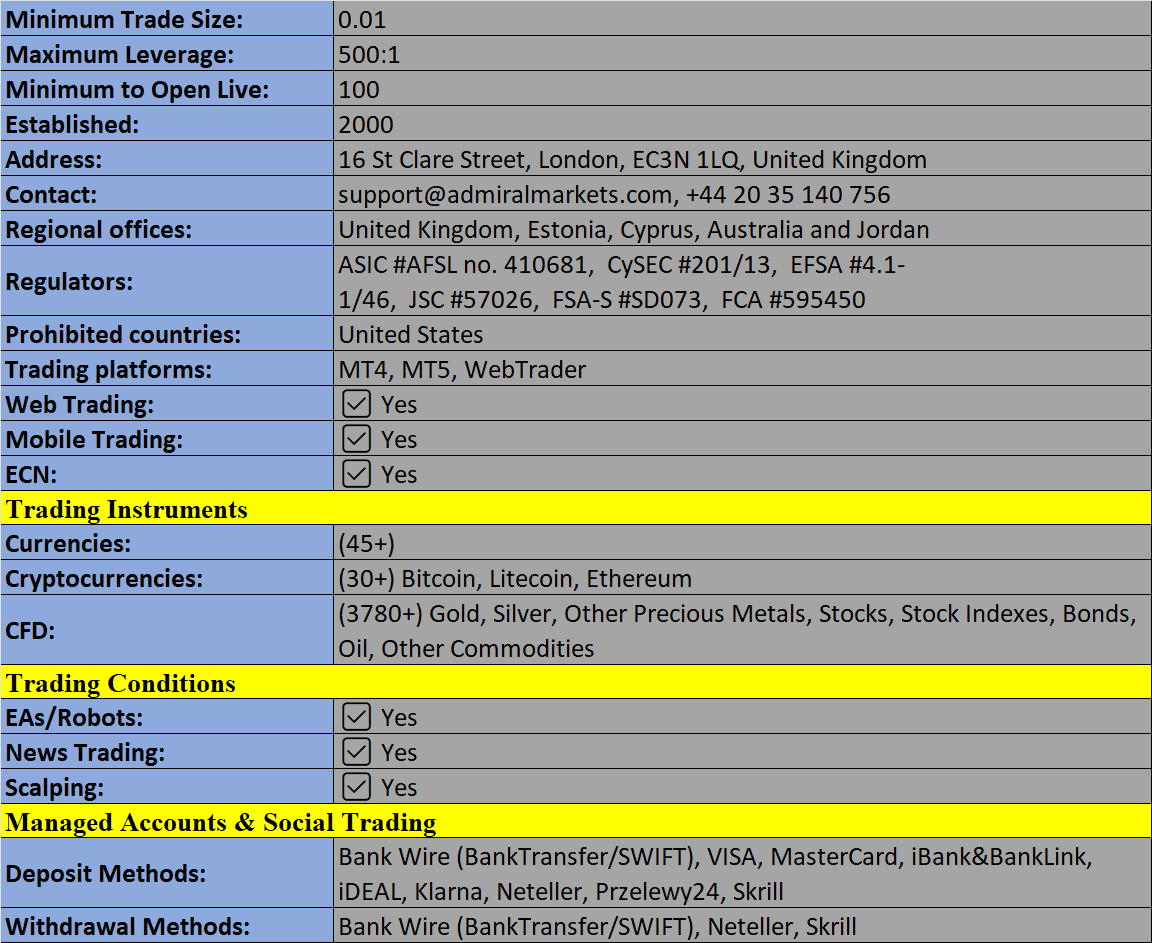

Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion